- Are you storing goods in Austria?

- Are you selling goods in Austria?

- Are you part of a FBA program?

If you’re storing in Austria or selling goods to Austrian customers you have to register for VAT in Austria. The hellotax team can not only help you with that, but also with the filing of VAT Returns and the communication with the Austrian tax authorities. We can assist you in all VAT related matters.

Dominik Larcher

Last Updated on 2 May 2022Why do I need to

register for VAT in Austria?

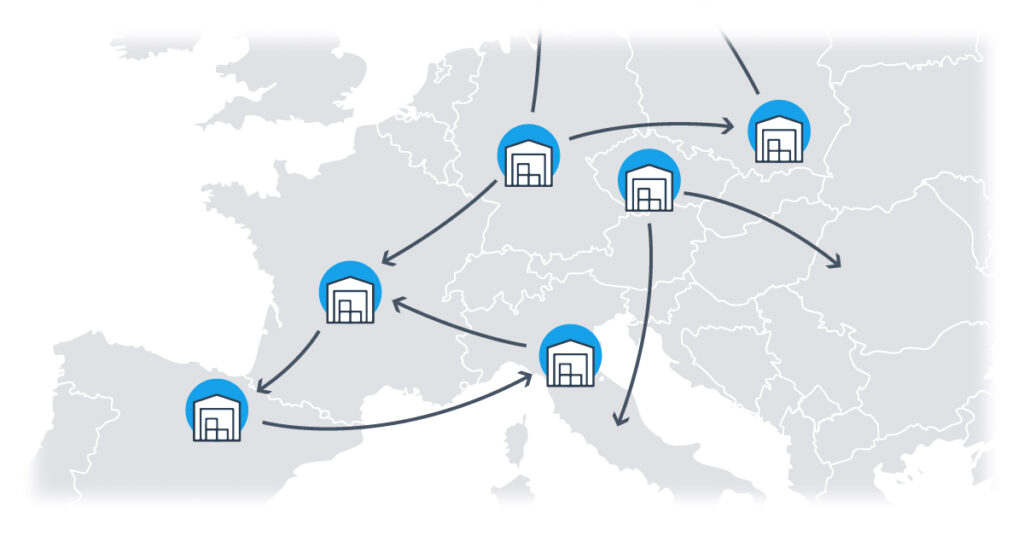

Reason 1: You are storing goods in warehouses in Austria

- A VAT Registration in EU-countries is necessary once you are storing goods in a specific country.

- It also applies to Austria. Once your wares are stored there, you need to register for VAT with the Austrian authorities.

- The registration is necessary whether the goods are stored independently or through a fulfillment provider which has warehouses in Austria.

Reason 2: You are participating in a Fulfilled-by-Amazon program

- The storage rules also apply to fulfillment programs, such as the FBA-programs by Amazon.

- By participating in one of those, you are authorizing the storage of your goods in a multitude of countries. For example, within the PAN-EU program goods are stored in a multitude of western European countries including but not limited to Spain, France, and Italy.

- If Austria is part of a program, you need to register for VAT there, as your goods might be stored in Austria.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

Reason 3: You are selling goods to Austrian customers crossing the EU-wide threshold

- Another reason to be subject to VAT is the crossing of the EU-wide threshold for distance selling of € 10,000

- If this threshold is crossed EU-wide, meaning through sales to one or more EU countries combined, a VAT registration in all those countries becomes mandatory. You might also need to file VAT Returns and tax declarations.

- However, if you choose to participate in the OSS-Program and are not storing goods in Austria, you don’t have to register for VAT in Austria but still tax your goods accordingly.

Are you distance selling on a large scale or storing goods in warehouses in Austria? Then you have to register for VAT in Austria or register for the OSS-Program. If you are storing goods, you might also have to start filing VAT Returns. Confused? No worries! Our team at hellotax can help you register for the appropriate identification numbers and with the filings to the corresponding tax authorities. All the while you can keep focusing on expanding your business in Austria.

How do I register for VAT in Austria?

As soon as you reach or pass the threshold limit, a registration for a VAT number in Austria is required. For the registration of a VAT number in Austria, you have to visit the website of the “Federal Ministry Republic of Austria Finance” and fill in and submit form U15. Be aware that this form only exists in German language! If you do not speak German yourself, hire a translator or representative to handle your VAT in Austria or simply use our hellotax VAT software and automate your VAT duties with hellotax.

Additionally the following documents need to be submitted:

- A specimen signature in original

- VAT certificate to prove the business is registered for VAT elsewhere in the EU, if appropriate (copy)

- Articles of Association (copy)

- An extract from the company’s national trade register (copy)

Some of the documents must be translated into Austrian language by a sworn translator and certified by a sworn notary! Once you have completed your registration, you will receive a Austrian VAT number.

How does the VAT ID look like in Austria?

| Name | Umsatzsteuernummer (UID-Nummer) |

| Country Code | AT |

| Format | AT + U + 8 digits |

| Example | ATU12345678 |

In order to avoid problems with the Austrian tax authorities it’s best to keep the regulations concerning storage, delivery threshold and OSS in mind. If you have to make VAT payments, our team and hellotax and our VAT automation tool can take over most of the work.

Check it out now!

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

The EU-wide threshold and

Distance Sales to Austria

As mentioned above, once the EU-wide threshold for distance sales of € 10,000 is reached, VAT registrations become mandatory in all countries in which you are selling. Prior to July 2021, country-specific thresholds, such as the Austrian one of € 35,000, were used to ascertain VAT subjectivity in each country. But since then the net worth of distance sales overall, meaning to all European countries combined, is the deciding factor. If the turnover remains below this threshold, then all goods can be taxed with the VAT rate of the business’s home country and the VAT is paid to the tax authorities in the home country. Once the threshold is reached, each additional Euro needs to be taxed with the VAT rate of the country to which the goods are sold. In that case, VAT registrations as well as the filing of VAT Returns are mandatory in each and all of these countries are mandatory as well.

Attention: It is no longer necessary to reach individual thresholds in each country. Instead, the decisive net worth of distance sales is the sum of all distance sales to European countries combined. If the threshold of € 10,000 is reached by regular sales to France, Spain, and Austria combined, then you need to register for VAT in all three countries.

Example: You are a distance seller from Germany and are selling to France, Spain, and Austria. Your annual net turnover is € 11,000 and is therefore exceeding the EU-wide threshold. € 6,000 of sales are made in France, € 3,000 in Spain, and € 2,000 in Austria and since you’re crossing the threshold you are obliged to register for VAT in all three countries. The first € 10,000 are still taxed with the German VAT rate, but each additional sale needs to be taxed separately. If you made all sales to France and Spain first and subsequently only sold to Austria, then half of those sales worth € 1,000 need to be taxed with the Austrian VAT rate.

What happens if I

participate in the OSS-Program?

The EU-wide delivery threshold of € 10,000 is no longer applicable once you register for the One-Stop-Shop. When using the One-Stop Shop, each distance sale of B2C goods or services is taxed with country-specific VAT rates, in the case of sales to Austria regularly 20%. On the plus side, the VAT is paid to the tax authorities in the businesses home country. They then redistribute the correct amounts to the authorities in the countries to which VAT is owed. That also means, that the individual VAT registrations and the filing of VAT returns abroad are no longer necessary.

Attention: While a VAT registration is first and foremost not necessary when using OSS and distance selling, the situation changes once goods are stored. Storage of goods always requires a foreign VAT registration. If goods stored are then sold to customers in the same country, e.g. goods stored in warehouses in Austria to Austrian end consumer, the VAT needs to be declared in an Austrian VAT declaration, Returns need to be filed and the VAT amount needs to be paid to the Austrian tax authorities directly.

Example: If the German distance seller from the example above is using OSS, each sale, including sales making up the first € 10,000 in turnover, need to be taxed with the French, Spanish, and Austrian VAT rates. However, all VAT is paid to the German tax authorities. They then send the correct VAT amounts to the French, Spanish, and Austrian authorities. The German seller does not need to register for VAT in Austria.

Overwhelmed? No worries! Our team at hellotax can not only help you decide if OSS is a good choice for your business. We can also help navigate VAT responsibilities in several countries and make sure you stay VAT compliant!

Hellotax One-Stop-Shop Solution

- Automated identification of B2C sales

- Automated determination of your tax rates

- Handling of OSS registrations and reports

- Quality control for your transactions

FAQ

The standard VAT rate in Austria is 20% which applies for most taxable goods and services in Austria. The reduced type of 13% applies for example to domestic flights or entrance to sporting events. There is also a 10% type; it applies for example for take-away food or water supplies. Intra-community and international transport (no road and rail!) a taxed with 0% VAT rate.

When to file your VAT returns in Austria depends on your annual sales. If your turnover exceeds €100,000 you have to file your VAT returns in Austria monthly. With a turnover between €30,000 and €100,000 you VAT returns in Austria a due quarterly. Below a turnover of €30,000, only an annual VAT return is required.

For monthly VAT returns the 15th day of the following month (e.g. February 15 for January), for quarterly VAT returns the 15th day of the following month of the last tax period (e.g. April 15 for the first quarter) and the annual return is due April 30 or if submitted online June 30.

After all the documents are submitted to the authorities and the registration process is completed, it takes about 5 weeks until you receive your Austrian VAT number.