- Are you storing goods in the Netherlands?

- Are you selling goods to Dutch customers?

- Are you part of a Fulfilled-by-Amazon program?

If you are storing goods in the Netherlands or selling goods to Dutch consumers you are obligated to submit a VAT registration. You might also have to file Dutch VAT returns and declarations and pay VAT to the Dutch authorities. hellotax can help you with all VAT duties that may arise in the Netherlands. Check out all our services by booking a free consultation!

Dominik Larcher

Last Updated on 2 May 2022When do I need to register for

VAT in the Netherlands?

Reason 1: You sell goods to Dutch consumers and cross the EU-wide threshold for distance selling

- The first and most important reason to register for VAT in the Netherlands is crossing the EU-wide delivery threshold of € 10,000 while selling to customers in the Netherlands.

- Crossing the threshold means being subject to VAT in each country to which goods are sold.

- Unless a seller participates in OSS, a VAT registration, the filing of returns and the payment of VAT in the Netherlands are then mandatory

Reason 2: You are storing your goods independently or through a fulfillment provider in the Netherlands

- The second action that causes VAT subjectivity is the storage of goods in an European country.

- Both independent storage and the storage of goods by a fulfillment provider require the seller to register for VAT in the country, in which the goods are stored.

- Under some circumstances the seller does not only have to submit a VAT registration, but also start filing returns and tax declarations.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

Reason 3: You are participating in a Fulfilled-by-Amazon Programme (FBA)

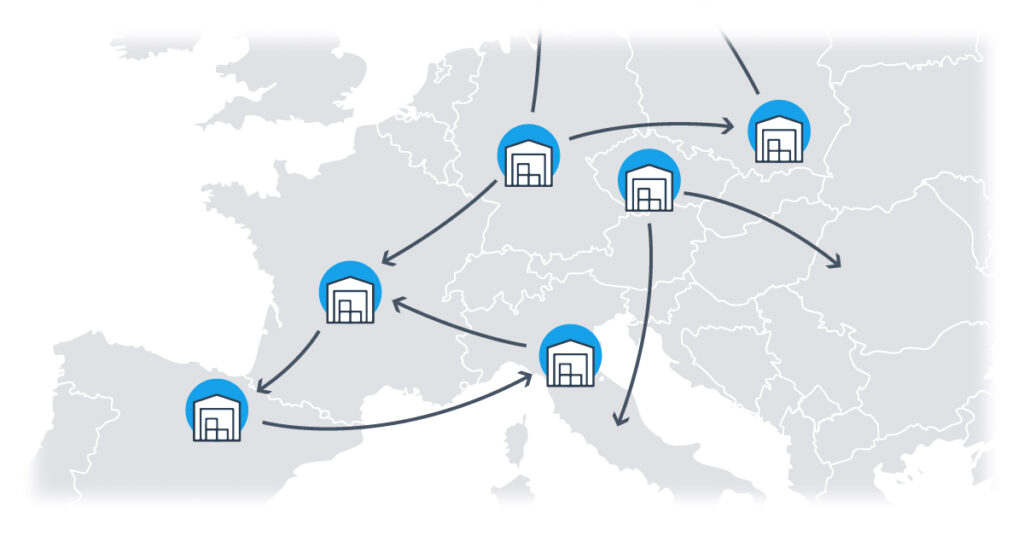

- Closely connected to the previous point is the participation in Amazon’s fulfillment programs, such as the CEE or PAN-EU program.

- Within the Central European program (CEE) your goods might be stored in Poland, the Czech Republic and Germany and send from there on to consumers. Within the PAN-EU program products may be stored in a multitude of western European countries.

- By participating in a program a seller is authorizing the storage in any of these countries and is therefore subject to VAT in all of them.

- If the Netherlands are part of a program, you need to register for VAT there, as your goods might be stored in the Netherlands.

Are you storing your goods in the Netherlands or crossing the EU-wide limit while distance selling to the Netherlands? In that case you not only need to submit a VAT registration to the Dutch authorities, you might also need to start filing VAT returns. We at hellotax can help you with both of those duties so you can keep concentrating on expanding your business in the Netherlands.

How to register for VAT

in the Netherlands

You register for VAT at the Dutch tax office, the so called “belastingdienst”. Try to apply as early as possible in order to not get into trouble with the Dutch tax office. To apply, visit the website of the “belastingdienst” and download and fill in the application form. Of course, you can register for VAT as well with just a few clicks directly in our VAT software.

Additionally the following documents need to be submitted:

- VAT certificate to prove the business is registered for VAT elsewhere

- Articles of Association

- Extract from the company’s national trade register

Some of the documents might have to be translated into Dutch language by a sworn translator and certified by a sworn notary! Once you have completed your registration, you will receive a Dutch VAT number.

How does the format of an Dutch VAT registration number look like?

| Name | BTW-identificatienummer |

| Country Code | NL |

| Format | NL + 12 digits |

| Example | NL123456789B01 |

If you want to avoid fines for late VAT registrations or VAT payments in the Netherlands, you should make sure you’re registering for a VAT ID or the OSS program in time. Fines can also arise due to late or false VAT returns. The team at hellotax and our automation tool can help you with all arising VAT duties and can make sure you stay VAT-compliant in the Netherlands.

Check it out now!

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

Distance Sales to the Netherlands

and the EU-wide threshold

Since July 2021, the first € 10,000 made through distance sales to other European countries are taxed with the VAT rate of the home country and the VAT is paid to the tax authorities there. However, each following sale after the € 10,000 threshold is crossed, needs to be taxed with foreign VAT rates and the amounts need to be paid to the tax offices in the countries to which the goods are sold. In order to do so a seller needs VAT IDs for each country, which can be obtained by registering for VAT with the local authorities. This ruling differs from the situation prior to July 2021, when country-specific VAT thresholds, such as the Dutch one of € 100,000, were used to ascertain VAT subjectivity in each country.

Attention: The new € 10,000 threshold applies EU-wide. That means that it is reached through sales to one or several EU countries combined. For example the threshold can be reached by several sales worth € 9,990 to France and only a single sale worth € 20 to the Netherlands. In that case a seller would still need to register for VAT in both countries.

Example: A German distance seller is wondering which countries he needs to register for VAT in. He knows he will have a turnover of € 6,000 in France, € 3,000 in Spain, and € 2,000 in the Netherlands. Combined, that turnover will exceed the delivery threshold of € 10,000. Therefore the seller needs to register for VAT in France, Spain, and the Netherlands and needs to obtain the corresponding VAT IDs. He is also wondering which VAT rates to apply. The first € 10,000 of sales will be taxed with the German VAT rate. Any additional sale however is subject to foreign VAT rates. If those sales are made to Dutch customers, they are taxed with the Dutch VAT rate.

How does participation in

the OSS-Program change the rules?

The exception to the basic rules of VAT registration comes in the form of the new OSS program, or One-Stop-Shop. Participation in this program is especially advantageous for businesses who distance sell to several countries, but never store there. Participants of the program need to use individual VAT rates for each single transaction as the EU-wide threshold is no longer applicable. However all VAT debt can be paid to the tax authorities in the home country and additional VAT registrations and VAT IDs are therefore no longer necessary.

Attention: While OSS exempts pure distance sellers from their VAT registration duties, this does not apply to sellers who store abroad. Once goods are stored in a country, a VAT registration there is absolutely mandatory, even if a seller uses OSS. If goods are then shipped from storage to private customers in the same country those sales need to be declared in an additional foreign VAT declaration and VAT needs to be paid directly to local authorities.

Example: The distance seller from the example above is considering using OSS instead of taking advantage of the EU-wide threshold. In this case he would need to apply the French, Spanish and Dutch VAT rates to his goods from the beginning. This could be a disadvantage if those rates are higher than the German one. On the other hand he wouldn’t need to register for VAT and take care of additional VAT duties as he would be paying all VAT amounts to the German authorities directly. Those would then redistribute the correct amounts to the French, Spanish, and Dutch tax authorities.

Not sure about which option to choose? Confused about the regulations? Don’t worry. Our team at hellotax can help you choose the right path for your business, can register you in the Netherlands or for OSS and assist you with all other VAT related matters.

Hellotax One-Stop-Shop Solution

- Automated identification of B2C sales

- Automated determination of your tax rates

- Handling of OSS registrations and reports

- Quality control for your transactions

FAQ

Yes, there are different VAT rates in the Netherlands. The standard VAT rate is 21% for most goods and services. There is a reduced rate of 9% for e.g. foodstuffs or water supplies. The VAT rate of 0% applies for the taxation of gold coins or intra-community transport by air and sea.

The standard VAT return period in the Netherlands is quarterly. However, you can be obligated to file monthly VAT returns. This is the case when you pay €15,000 of VAT per quarter.

Dutch VAT returns are due the 30th day of the following month following the last tax period. Example: April 30 for the first quarter.

After all the documents are submitted to the authorities and the registration process is completed, it takes about 3 to 4 weeks until you receive your Dutch VAT number.