There is hardly a better feeling than to see people ordering our products, right? In everyday life, however, we are now confronted with topics such as packaging, shipping and accounting – and the latter in particular is not always that easy. Amazon is trying to remedy this with the VAT Calculation Service. This service is supposed to simplify the VAT registration and pre-registration for the retailer.

Antonia Klatt

Last Updated on 26 July 2021

What is the Amazon VAT Calculation Service?

For this purpose, Amazon has launched a complete catalog of services, called Amazon VAT Calculation Services, which is intended to simplify the VAT registration and advance notification of Amazon retailers. For 400, – EUR per year, VAT registration, declaration and submission are done by Amazon itself via the so-called Seller Central in less time than usual.

Amazon only offers the services in selected countries, which are:

- Germany

- Great Britain

- France

- Italy

- Spain

- Poland

- Czech Republic

Direct neighboring countries such as Austria or the Netherlands are excluded. The first restrictions of the VAT Calculation Service from Amazon are already visible here and more will follow in the further course of the article.

In contrast, hellotax offers VAT registration and advance VAT returns in all member states of the European Union. Anyone who wants to work with a single provider long term, regardless of where they are expanding to, would be on the safe side and does not have to invest any additional manual effort later, for example to connect Austria or the Netherlands.

With our digital registration process, you can register for VAT wherever you sell products with just a few clicks. We only need some information about your company, which you simply enter in the appropriate input fields and then we will show you all the documents you need. If you upload it to us, we will do the rest and register you for your VAT identification number. There is nothing more to do – and we will inform you as soon as your new VAT ID is available.

Hellotax One-Stop-Shop Lösung

- Automatisierte Identifizierung von B2C-Verkäufen

- Automatisierte Ermittlung deiner Steuersätze

- Abwicklung von OSS-Registrierungen und Meldungen

- Qualitätskontrolle für Deine Transaktionen

Cost of the Amazon VAT Calculation Service

The annual fee of EUR 400 for the Amazon VAT services includes the following services for the above countries: VAT registration, VAT returns, advance VAT returns, Intrastat and ESL.

The Limits of Amazon VAT Calculation Services

First of all, Amazon’s offer gives the impression of being a comprehensive support for your tax matters as an Amazon dealer. However, this is not the case and so there is a risk of neglecting tax issues, which are strictly monitored by the tax authorities and, if necessary, penalized. The obvious is first of all the limitation that not all countries are available.

Überwache deine Lieferschwellen

Um zu wissen, was gerade los ist, liefert dir unsere Software zur Automatisierung der Umsatzsteuer alle relevanten Informationen.

Delivery thresholds are not monitored

But there is more: Anyone who sells products abroad as a German retailer cannot avoid the issue of delivery thresholds. If only small sale numbers are initially achieved with international sales, this can soon increase – and therefore become tax-relevant. If the delivery threshold with the annual net sales is exceeded in a specific country, VAT registration and the associated submission of VAT returns is required in the respective country. If this is recognized too late, there is a risk of legal consequences that can result in high fines.

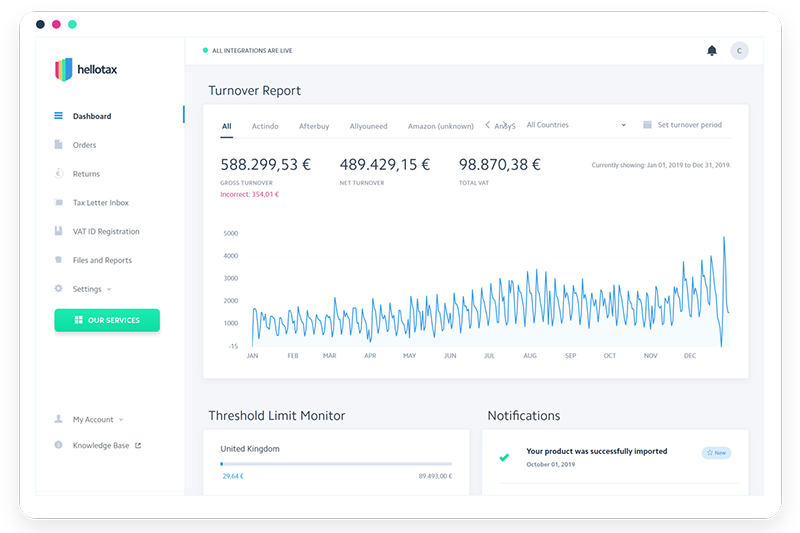

Hellotax can help here. In addition to the services that Amazon offers, hellotax also monitors your delivery thresholds with the help of specially developed VAT software and automatically gives you a signal if you are about to exceed them. Thias way you always have an overview of when and where you need to take action and register a VAT ID. This avoids unnecessary trouble with the tax authorities of the countries in which you are selling products and gives you the opportunity to act early enough and to prepare for the exceeding of the delivery threshold. This is important since the VAT registration process can take months in some countries.

Reverse charge procedure for B2B deliveries

In some countries there are peculiarities in the tax procedure. One concern, for example, is the reverse charge procedure for B2B deliveries in France. If you sell products to a French company it constitutes a B2B delivery. In this case, you issue the recipient of the service with a net invoice with a reference to the reverse charge procedure. This means that you don’t pay taxes, but the French recipient himself does. However, Amazon’s VAT Calculation Services cannot handle such special challenges.

Tax-free B2B deliveries

The next shortcoming of Amazon’s VAT Calculation Service also concerns B2B deliveries, in this case tax-free intra-community B2B deliveries. Amazon recognizes this and calculates the VAT, but this is only the first step that needs to be taken in this process – Amazon does not map the further steps.

In the case of a tax-free intra-community B2B delivery, in addition to the invoice, you also have to submit a document that proves that the delivery actually arrived abroad, such as proof of dispatch. It should be noted here that the receipt can of course be clearly assigned to the invoice. In addition to proof of dispatch, it is also advisable to have your customers’ VAT identification number confirmed at least once a quarter via the interface of the Federal Central Tax Office.

Amazon does not provide any information about whether the VAT IDs, which are stored once, are checked regularly. This can give you unnecessary headaches later when you deal with companies that use a no longer valid VAT ID.

Difficult communication with your customers

Using Amazon’s VAT Calculation Service makes a lot of things easier for you as a Amazon seller, but it also restricts you. You have to deactivate your own invoicing and submit this topic to Amazon. The invoices all look the same – they can only be customized by entering your company name. This in turn limits you in terms of branding and customer loyalty. You cannot use your own logo, make decisions about the individual appearance of your invoice, or include the domain for your website, etc.

Your personal contact person is missing

Anyone who uses services such as Amazon’s VAT Calculation Service is happy about the automation of their processes – and for good reason. A lot of work is done for you and you are given a feeling of security. This, in turn, is deceptive if the services do not cover all aspects of your VAT registration and pre-filing and you don’t keep certain critical topics in mind.

With a sensitive topic such as VAT registration and advance notification or accounting, it is therefore always good to know that there is someone you can approach if you have any questions. There is Amazon support, but long waiting times are to be expected and the answers are not always satisfactory. Various customers have already noticed a wide variety of errors in the accounting department due to Amazon, the rectification of which was very complex and time-consuming due to the poor contact options. Especially for beginners who do not have all accounting topics in mind, Amazon’s VAT Calculation Service should be treated with caution.

hellotax is aware of this challenge. That’s why we provide each of our customers with a contact person who takes care of your inquiries quickly and personally.

hellotax provides a remedy to these VAT Calculation problems

The alternative to the Amazon VAT Calculation Services is called hellotax. Our software as well as our services map the topic of VAT holistically. It starts with the VAT registration in the various EU countries, continues with the VAT filings and returns and even includes the monitoring of the delivery threshold and generates One-Stop-Shop reports for B2C cross-border transactions.

hellotax takes care of VAT filings and returns

As entrepreneurs, trouble with the tax office is the last thing we want. Therefore it is of great importance to adhere to the deadlines and guidelines of the tax authorities of the respective country. hellotax manages all your documents and deadlines in one place. We receive your tax mail via the Tax Letter Inbox and our software scans it. This is how we access data such as deadlines and costs to be paid from the documents.

You can find these clearly displayed in your software at any time, so that you always know what is coming up when. In the next step, if you wish, our software will automatically take care of the creation of your VAT filings and returns. These are then checked by our AI and our tax experts as the final control instance.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

If you have to make payments, consider circumstances or meet deadlines, we will simply inform you by email and in the software. You always have your taxes in view and you won’t fall behind with any tax office.

The hellotax software: your dashboard for all your tax issues

Our self-developed VAT software takes care of everything that you as a trader have to consider in everyday tax law. In addition to meeting deadlines or preparing VAT returns, it also informs you when delivery thresholds have been reached – so that you can quickly complete your VAT registration with us and receive your VAT ID from the respective country in time.

In our tool you can see all your movements of goods, create proforma invoices and analyze your data in detail so that you can further optimize your business.

Conclusion

The Amazon VAT Calculation Service is a seemingly simple and fast way to outsource the topic of taxes. Unfortunately, many features are not offered, so that you get a false sense of security. For those who are well versed in tax issues and would like to supplement Amazon’s services with their own effort, the VAT Calculation Services from Amazon are a good option.

If, on the other hand, you want comprehensive VAT software that frees you holistically from this topic and informs you at any time if you have to take personal action, hellotax is ideal. A personal contact person is available for you at any time if something is not clear and you want to reinsure yourself.

Nowadays, Amazon retailers no longer have to be a tax specialist – software like hellotax takes you by the hand and guides you safely through the jungle of international tax authorities.