- Do you store products in warehouses in Poland?

- Do you sell products to Polish consumers?

- Do you use a fulfillment-by-Amazon program?

For our most updated information on VAT in Poland, please, check here.

Dominik Larcher

Last Updated on 9 May 2022

In that case, VAT Returns may be required in Poland. But first you should register for VAT. The hellotax team will be happy to support you with the registration, filings of Returns and communication with the Polish authorities.

When do I have to submit

VAT Returns in Poland?

1. You sell goods to Poland and cross the EU-wide delivery threshold

- If you sell goods to end customers in several European countries including Poland and exceed the EU-wide annual threshold of € 10,000, you have to submit a VAT Return in Poland.

- After crossing the European delivery threshold, you are subject to VAT in all countries you sell to, including Poland.

- Then you not only have to submit VAT Returns, but also have to register for VAT and pay VAT in Poland.

- The only exception to this rule is participation in the OSS program as long as goods are not stored in Poland.

2. You store goods in Poland

- Storage in another EU country leads to VAT subjectivity, regardless of delivery thresholds.

- In addition to storage by fulfillment providers, this also includes storage by the seller themselves and storage through Amazon’s fulfillment programs.

- In all of these cases, you will need to register for VAT and also start filing Returns.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

3. You are participating in a Fulfilled-by-Amazon (FBA) program

- One of the storage options mentioned above is Amazon’s fulfillment programs.

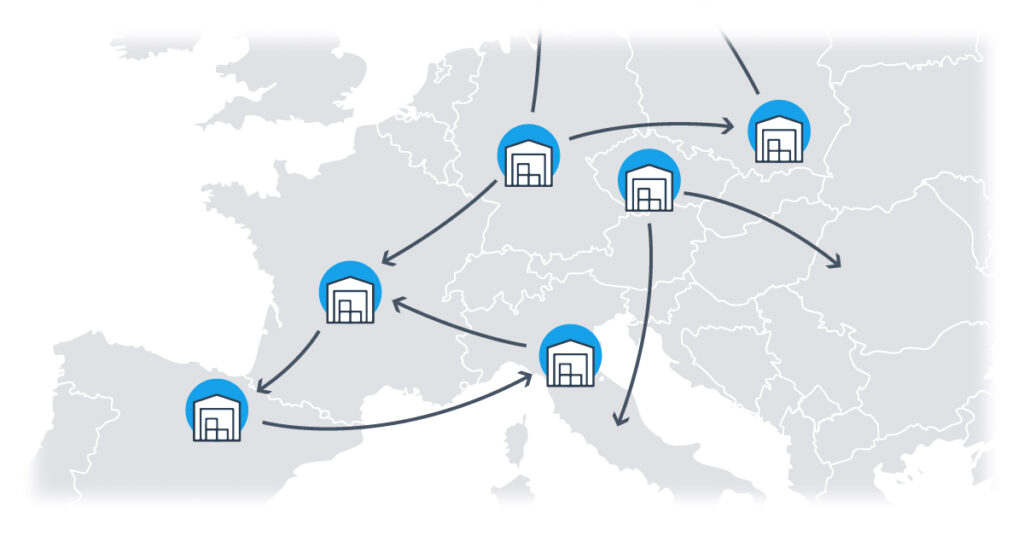

- Participation in one of these programs, which include warehouses in Poland, authorizes Amazon to store in and ship your goods from different countries.

- When products from these warehouses are then sold to customers in Poland, the sales must be listed in Polish VAT Returns.

Do you sell on a large scale or do you store goods in Poland?

Then you have to submit VAT Returns in Poland. You also need to register for VAT. But don’t worry! Just contact us and we will take care of the VAT registration and filings. This way you can continue to focus on doing business in Poland.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

How to file

VAT Returns in Poland

VAT Returns in Poland are filed electronically via the Polish Standard Audit File for Tax, or SAF-T, which replaced the standard VAT Returns from 2020 on. The SAF-T generally consists of five requirements:

- General ledger and supporting journals

- Accounts payable, including supplier master data and invoices

- Accounts Receivable, with customer master data and invoices

- Warehouse inventories, and master data

- Fixed assets ledger, including amortisation

In Poland, VAT Returns are due on the 25th of each month for the previous tax period. Some businesses may choose to file quarterly Returns but based on their turnover may still be required to prepay VAT on a monthly basis. In case of late filings, the penalties consist of interest on the unpaid VAT of at least 8%.

In order to file VAT Returns a business must first register with the polish tax authorities and obtain a polish VAT ID. In order to do so, the tax identification number form (NIP-2) and VAT registration form (VAT-R) must be submitted.

You can simplify both VAT registration and the filing of VAT Returns in Poland by using the hellotax VAT automation tool. We help you automate VAT payments, correspond with the authorities and make sure you stay VAT compliant!

The EU-wide delivery threshold and OSS

In July 2021, the previous country-specific delivery thresholds for B2C distance selling were replaced by an EU-wide threshold of € 10,000. Instead of the Polish delivery threshold of PLN 160,000, VAT registration and submission of VAT Returns in Poland are now required if the net turnover of B2C distance sales in European countries exceeds a total of € 10,000. The first € 10,000 sales will continue to be taxed at the VAT rate of your home country. However, each additional Euro must be taxed with the country-specific, e.g. Polish VAT rates and the VAT must also be paid there.

However, if the seller registers for the One-Stop-Shop or OSS, the delivery threshold can no longer be used. Each individual sale is then taxed with country-specific VAT rates. However, the sales are listed in a single VAT Return that is filed with the local authorities. The entire VAT is also paid to them. The local tax office then distributes the correct amounts to the foreign authorities. Therefore, no further VAT-IDs are required as long as goods are not stored in other EU countries.

Example: A German distance seller with annual net sales of € 11,000 through sales to France, Spain and Poland is considering taxation. If the EU-wide threshold is used, sales of € 1,000 must be taxed at country-specific VAT rates, such as the Polish one. In addition, registration and submission of Returns are mandatory in every country including Poland. If the seller uses the OSS program, € 11,000 in sales are taxed at foreign VAT rates. However, the entire amount is paid in Germany and VAT Returns are filed there. If the seller participates in a fulfillment program and goods may be stored in Poland, registration for VAT in Poland is still required. If products are then sold to Polish customers from a warehouse in Poland, these must be listed on VAT Returns in Poland.

Registration problems? The hellotax team can support you with the registration for OSS as well as for the VAT identification number in several European countries. We and our automation tool also take care of the submission of VAT-related documents while you can continue to concentrate on your business.

Hellotax One-Stop-Shop Solution

- Automated identification of B2C sales

- Automated determination of your tax rates

- Handling of OSS registrations and reports

- Quality control for your transactions

When do I need to file VAT Returns in Poland?

VAT Returns in Poland are due on the 25th of the month following the tax period using the VAT 7 document or using the VAT 7K document if the business opted for quarterly Returns. Other filings, such as Reverse Charge Listings or Sales Invoices are due at the same time.

| Filing | How often? | Deadline? | Document? |

| VAT Return | Monthly | 25th of the following month | VAT 7 in PDF format |

| Quarterly | 25th of the following month | VAT 7K in XML format | |

| EC Listing | Monthly or Quarterly | 25th of the following month | VAT UE in PDF format |

| Monthly or Quarterly | If required | VAT UEK in PDF format | |

| Intrastat | Monthly | 10th of the following month | Intrastat Declaration in XML format |

| Reverse Charge Listings | Monthly or Quarterly | 25th of the following month | VAT 27 and VAT 27K in XML format |

| Sales Invoice | On request from authorities | Within 3 days | JPK_FA |

| VAT Books | Monthly | 25th of the following month | JPK VAT in XML format |

Frequently Asked Questions

How often do I need to file VAT Returns in Poland?

In general, you need to file Returns and pre-pay VAT on a monthly basis. Some businesses can choose to file quarterly Returns when registering for a polish VAT number. Only those whose annual turnover exceeds ~ €1,100,000 need to pre-pay VAT each month.

What happens if I don’t file VAT Returns?

The penalties for late filings equal an interest charged on unpaid VAT of twice the rate set by the Polish National bank +2% or a minimum rate of 8%. Professionals at hellotax can also help you register for VAT and file Returns retroactively.

How do I register for VAT in Poland?

In order to obtain a VAT ID and start filing VAT Returns in Poland you need to fill out and submit the NIP-2 and VAT-R forms. Some other documents, such as VAT certificates and Business Registration also need to be translated and submitted.

What are the different VAT rates in Poland?

In Poland, the standard VAT rate on goods and services is 23%. A reduced rate of 8% includes for example mustard, sweet pepper (spice), some more processed and unprocessed spices. The second type is the rate of 5% and taxes for example tropical and citrus fruit or hygienic articles. Intra-community transports have a tax rate of 0%.