- Do you store goods in Czech warehouses?

- Do you sell goods to Czech customers?

- Do you ship goods using an FBA program?

In this case, you may need to file VAT returns. hellotax can help with VAT registrations, filings of returns and communication with local authorities – with all VAT related tasks.

Dominik Larcher

Last Updated on 4 May 2022When does a Czech VAT Return

have to be filed?

1. When the EU-wide delivery threshold for distance selling is exceeded

- VAT returns are required in the countries in which trading takes place if the net turnover from B2C distance selling exceeds the EU-wide delivery threshold of € 10,000.

- If this threshold is exceeded, VAT registration and regular VAT returns are also required.

- However, if there is an OSS registration and goods are only sold but not stored in the Czech Republic, this rule does not apply (more information below).

2. When goods are stored in the Czech Republic

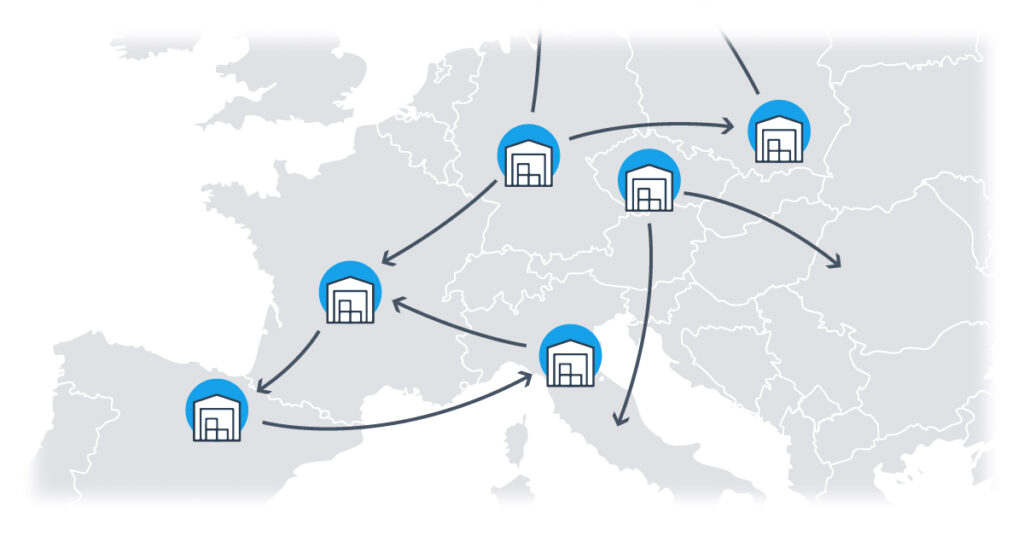

- As soon as goods are stored in the Czech Republic or another European country, you are liable for VAT there.

- This includes both independent storage and storage as part of a fulfillment program or by a fulfillment provider with warehouses in the Czech Republic.

- In all of these cases, VAT registration and the submission of VAT returns are essential.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

3. When participating in a Fulfilled by Amazon (FBA) program

- If you sell products on Amazon and they are shipped through a Fulfilled-by-Amazon program, they are also stored in a variety of countries.

- If one of these warehouse countries is the Czech Republic, then you have to register for VAT there and receive a Czech VAT identification number.

- Products that are then sold to Czech end consumers from a warehouse in the Czech Republic must be listed in a Czech VAT return.

Do you store goods in the Czech Republic or do you exceed the EU-wide delivery threshold? In this case, VAT returns in the Czech Republic are mandatory. VAT registration is also required. Overwhelmed? Do not worry! We support you with the registration and submission of tax documents.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

How to file VAT Returns

in the Czech Republic

VAT returns in the Czech Republic are filed electronically with the 25401 form via the website of the Financial Administration of the Czech Republic and are due on a monthly basis. If the business’ turnover did not exceed CZK 10,000,000 in the previous year, a seller can choose to only file returns quarterly.

To file returns, a VAT ID must be obtained from the czech tax authorities. In order to obtain that number, an application for VAT registration including a VAT certificate to prove the business is registered for VAT elsewhere in the EU, a licence to perform economic activities and an extract from the company’s national trade register needs to be submitted to the czech tax office in Prague.

Late or incorrect filings, as well as failure to register for VAT are punishable with penalties. Incorrect filings are fined with 20% of the additional VAT debt, late payments are fined with the rate set by the Czech National Bank plus 14%, and failure to register is fined with up to CZK 300,000 (about € 11,750). That’s why it’s important not only to file returns on time, but also to remember when registering for VAT in the Czech Republic becomes obligatory.

You can simplify both VAT registration and the filing of VAT returns in the Czech Republic by using the hellotax VAT automation tool. We help you automate VAT payments, correspond with the authorities and make sure you stay VAT compliant!

The EU-wide delivery threshold and OSS

Until now, country-specific delivery thresholds, such as the Czech one of 1,140,000 CZK, applied in the EU. Once the threshold was exceeded by B2C distance sales to Czech customers, VAT registration and the submission of VAT returns in the Czech Republic were mandatory. That changed in July 2021. Since then, a € 10,000 delivery threshold has been in effect across the EU. Sales that do not exceed this limit are charged with the domestic VAT rate and declared in the course of the domestic VAT return. Sales that exceed the limit, however, lead to VAT liability in these countries. Then registration for VAT and the submission of VAT returns are required and the goods must be taxed at the foreign VAT rates.

The exception to this rule is the One Stop Shop, or OSS. In this case, the country-specific foreign VAT rates are used from the first Euro in sales on, but VAT registrations are no longer necessary. This is because all sales are declared in a single VAT return in the home country and the entire tax is paid to the local tax office. The authorities then distribute the correct amounts to the foreign tax offices. This regulation applies as long as no goods are stored in other EU countries.

Example: A distance selling company based in Germany with an annual net turnover of € 11,000 through sales to France, Poland and the Czech Republic is considering taxation. If they use the delivery threshold, € 1,000 of sales must be taxed with country-specific VAT rates, such as the Czech one. In addition, the company has to register for VAT in all three countries, including the Czech Republic, and henceforth submit VAT returns. If they have registered for the OSS, the situation is different. Then € 11,000 in sales must be taxed at foreign VAT rates, but the entire VAT is paid in Germany. A registration in the Czech Republic is no longer necessary. However, as soon as goods are stored in the Czech Republic, for example as part of an Amazon fulfillment program, registration is required again. If goods are then sold from this warehouse to customers in the Czech Republic, a VAT return must then be submitted in the Czech Republic for these sales.

Confused? Do not worry! The hellotax team can advise you on all VAT-related issues and also support you with submitting VAT returns and communicating with the Czech authorities. Contact us today!

Hellotax One-Stop-Shop Solution

- Automated identification of B2C sales

- Automated determination of your tax rates

- Handling of OSS registrations and reports

- Quality control for your transactions

When do I need to file VAT Returns in the Czech Republic?

VAT Returns in the Czech Republic are due on the 25th of the month following the tax period using form 25401. So are EC Listings. Other filings, such as Intrastat are due on the 10th or 12th working day of the following month. Monthly filings are to be submitted in PDF, quarterly filings in XML format.

| Filing | How often? | Deadline? | Document? |

| VAT Return | Monthly | 25th of the following month | Form 25401 in PDF format |

| Quarterly | 25th of the following month | Form 25401 in XML format | |

| EC Listing | Monthly | 25th of the following month | Form 5521 in PDF format |

| Quarterly | 5th of the following month | Form 5521 in XML format | |

| Intrastat | Monthly, Quarterly or Yearly | 10th working day if submitted in paper form or 12th if submitted in electronic form | Intrastat Declaration in XML format |

| VAT Books | Monthly or Quarterly | 25th of the following month | DPHKH1 in XML format |

Frequently Asked Questions

How often do I need to file VAT Returns in the Czech Republic?

In general, you need to file Returns on a monthly basis. Businesses whose turnover in the previous year did not exceed CZK 10,000,000 or about € 390,000 can choose to file quarterly VAT Returns instead.

What happens if I don’t file VAT Returns?

The penalties for late filings equal an interest charged on unpaid VAT of the rate set by the Czech National Bank +14%. Additional penalties for failures to register and errors in the Return filings apply. Professionals at hellotax can also help you register for VAT and file Returns retroactively.

How do I register for VAT in the Czech Republic?

In order to obtain a czech VAT ID, an application including a VAT certificate, a licence to perform economic activities and an extract from the company’s national trade register needs to be submitted to the czech tax office in Prague.

What are the different VAT rates in the Czech Republic?

The standard VAT rate on goods and services is 21%. A reduced rate of 15% includes for example foodstuffs, livestock, water, books and newspapers, construction, cultural and sports events, and household services. A reduced rate of 10% applies on pharmaceuticals, e-books and baby foodstuffs while financial and postal services are exempt from czech VAT.