- Do you sell goods in France?

- Do you store goods in France?

- Do you take part in a fulfillment program?

If you said “Yes!” you may have to register for VAT in France. In that case, VAT returns in France must also be submitted. The hellotax team will help you with the VAT registration as well as with the submission of returns and the contact with the authorities – with all arising tasks on the subject of VAT.

Dominik Larcher

Last Updated on 8 July 2025When do I have to submit VAT Returns in France?

1. You sell goods to French customers and cross the EU-wide delivery threshold

- If you B2C distance sell goods to several European countries including France and the EU-wide annual delivery threshold of € 10,000 is exceeded, you have to submit a VAT return.

- You also have to register for VAT in France and file VAT returns, as after crossing the threshold you will be subject to VAT in all countries in which you sell.

- The only exception to this is the One Stop Shop. But only as long as goods are only sold in France, but not stored.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

2. Your goods are stored in France

- This is because storage in another EU country leads to VAT liability in that country.

- Then not only a VAT registration is required, but also the submission of VAT returns.

- Both independent storage and storage via a fulfillment provider are considered storage in other EU countries.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

3. You are participating in an FBA (Fulfilled-by-Amazon) program

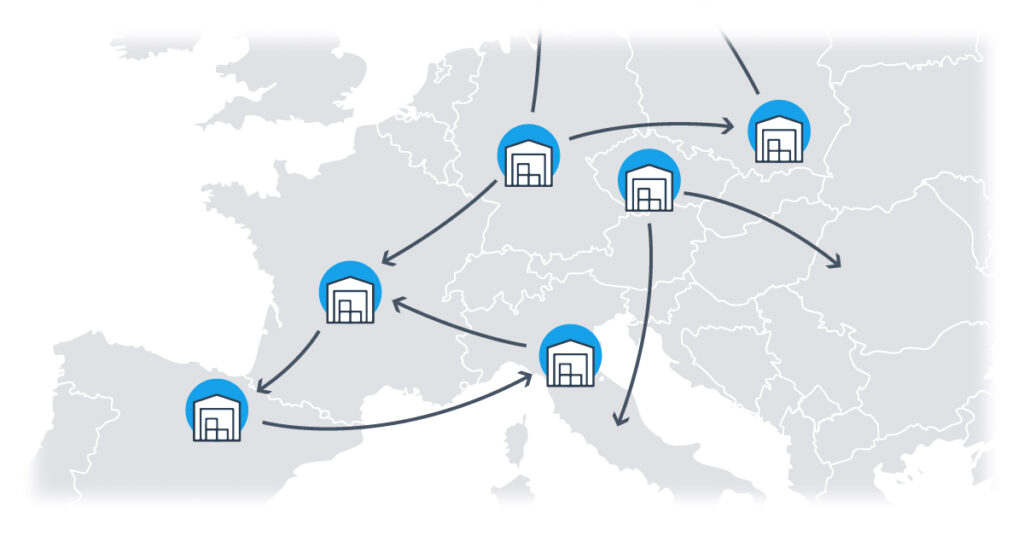

- One of these storage options is Amazon’s FBA programs, in which products are stored in a variety of countries.

- For example, under the PAN-EU program, goods are stored in some Western European countries, including Spain, France and Italy.

- If you participate, you must register for VAT in all participating countries, as your products may be stored there.

- Sales from warehouses in France to customers in France must then be declared in a French VAT return.

Do you store goods in France or do you exceed the delivery threshold for distance selling?

In this case, VAT returns are mandatory in France. VAT registration in France is also required. Overwhelmed? Do not worry! We support you with the VAT registration and filing of returns. Contact us and keep focusing on your business in France.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

How to file

VAT Returns in France

VAT returns in France are filed electronically with the French form CA 3 to the Paris tax office, and VAT is paid via an account on the French tax authorities’ website.

VAT returns are due between the 15th and 24th of each month for the previous tax period, and generally are to be filed monthly. Some businesses may choose to file quarterly returns based on their turnover and previously due VAT. This is the case if:

- The turnover through the sale of goods lay between € 82,800 and € 789,000, OR the turnover through the supply of services lay between € 33,200 and € 238,000, AND the total VAT debt lay below € 15,000 in the previous year.

- The turnover through the sale of goods was above € 789,000, OR the turnover through the supply of services was above € 238,000, BUT the total VAT debt did not exceed € 4,000 in the previous year.

In order to file VAT returns a business must first register with the french tax authorities and obtain a french VAT ID. In order to do so, an application including the VAT certificate of the country of origin, as well as an extract from the national trade register, needs to be submitted to the tax office in Paris.

While there are no penalties for a delayed registration, in case of late return filings, up to 5% interest will be added to the VAT amount due. Additional fines range from 0,2% for errors up to 80% for continued delays. That’s why it’s important to keep deadlines and VAT duties in mind when distance-selling to France.

Note: Since 2024, France has also applied fixed penalties for missing electronic declarations, typically €60–€150 per declaration depending on the type of omission.

You can simplify both VAT registration and the filing of VAT returns in France by using the hellotax VAT automation tool. We help you automate VAT payments, correspond with the authorities, and make sure you stay VAT compliant!

Update 2025: The EU has begun implementing new “VAT in the Digital Age” (ViDA) reforms, introducing more digital reporting and data-sharing requirements. While most online sellers still file French VAT returns using the CA3 forms, it’s important to prepare for transaction-level digital reporting obligations that are rolling out across the EU. France is expected to expand mandatory e-invoicing requirements in the coming years.

OSS and the EU-wide delivery threshold

In July 2021, a new threshold of € 10,000, which applies across the EU, replaced the previous country-specific delivery thresholds for distance selling. The French threshold was previously € 35,000, from which on VAT registration and the submission of returns in France were required. Since then, it is now necessary to register and submit VAT returns if the net turnover of B2C distance selling in European countries exceeds a flat rate of € 10,000. While the first € 10,000 are taxed at the VAT rate of your home country and the VAT is paid to the authorities in your home country, each additional Euro must be charged with the country-specific, for example the French, VAT rate and the tax is paid in the country of destination.

The delivery threshold does not apply if a seller uses the One-Stop-Shop or OSS. In this case, each sale is taxed at a certain VAT rate, but returns are filed and all tax is paid in the home country. The authorities then distribute the correct amounts to foreign tax offices. VAT identification numbers and the submission of VAT returns are also not required as long as the goods are not stored abroad.

Example: You are a German distance seller with an annual net turnover of € 11,000 through sales to France, Spain, and Poland. If you take advantage of the regulations of the EU-wide delivery threshold, only the last € 1,000 turnover must be taxed with country-specific VAT rates such as the French one. But it is still mandatory to register and submit returns in each of the three countries, including France. If you use the OSS instead, € 11,000 of sales will be taxed at foreign VAT rates, but the entire VAT will be listed in VAT returns and paid in Germany. However, if you participate in a fulfillment program or have hired an e-fulfillment service provider, and goods may be stored in France, registration is still required. If goods are then sold to French customers from a French warehouse, these sales must be declared in France in an additional VAT return.

Not sure whether registering for OSS is the right thing to do? The hellotax team can advise you on this decision and continue to support you afterwards. We help with registrations for VAT or the OSS, with the submission of tax documents, and of course with the VAT payments.

Hellotax One-Stop-Shop Solution

- Automated identification of B2C sales

- Automated determination of your tax rates

- Handling of OSS registrations and reports

- Quality control for your transactions

When do I need to file VAT Returns in France?

VAT Returns in France are due between the 15th and 24th of the month following the tax period using the 3310 CA3-SD and 3310 A-SD forms.

| Filing | How often? | Deadline? | Document? |

| VAT Return | Monthly or Quarterly | Between the 15th and 24th of the following month | 3310 CA3-SD and 3310 A-SD in PDF format |

| VAT Return (Annex) | Monthly or Quarterly | Between the 15th and 24th of the following month | 3310 A-SD (Annex) in PDF format |

| EC Listing | Monthly | 10th working day of the following month | CERFA_13964 (DES) |

| Intrastat | Monthly | 10th working day of the following month | CERFA_10838 (DEB) |

| VAT Group Return | Monthly | 24th of the following month | 3310-CA3G-SD in PDF format |

| 8th Directive | Yearly | January | 3519-SD in XML format |

French tax authorities have also intensified electronic audits comparing DEB, DES, and CA3 filings to identify inconsistencies. It’s crucial to keep records aligned.

Frequently Asked Questions

How often do I need to file VAT Returns in France?

In general, you need to file Returns on a monthly basis. Some businesses can choose to file quarterly Returns if their annual turnover and previous VAT amounts due lie below certain thresholds.

What happens if I didn’t file VAT Returns?

The penalties for late filings equal an interest charged on unpaid VAT of about 5%. Additionally there are 0,2% penalties for errors, as well as fines of up to 80% for repeated delays. Professionals at hellotax can also help you register for VAT and file Returns retroactively.

How do I register for VAT in France?

In order to obtain a VAT ID and start filing VAT Returns in France you need to fill out and submit an application for VAT registration with the french tax authorities. Some other documents, such as VAT certificates and an extract from the national trade register also need to be translated and submitted.

What are the different VAT rates in France?

In France, the standard VAT rate on goods and services is 20%. A reduced rate of 10% applies to some food items, transport, pharmaceuticals, cultural services, hotel accommodations, bars and cafés etc., while 5.5% apply on water supplies, books, events, and sanitary products and 2.1% apply to newspapers, cultural events and livestock.