VAT ensures the proper handling of taxes when selling in Europe. All goods and services sold in the EU are subject to this consumption tax. Only VAT-compliant sellers are allowed to sell in Europe, so meeting all the regulations is crucial to building a successful e-commerce business. This article will discuss the most important topics related to VAT rates in the EU.

Maria

Last Updated on 31 July 2025What is the VAT rate?

All goods and services in the EU are assessed with the VAT, a pan-European consumption tax. There are different guidelines and VAT rates for different product categories and business fields in every member state of the European Union.

EU law allows two reduced rates, with the lowest being 5% or higher. Prior to their EU membership, some countries had a third, reduced VAT rate in place. Through European VAT Directives, the EU sets the broad VAT rules, and 15% is the minimum standard VAT rate.

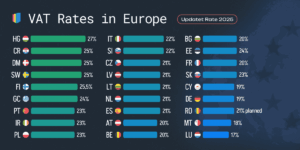

Overview of the VAT Rates in Europe 2025

Our list includes all European countries, their VAT rates, and the categories of products they apply to. We’re sure that you’ll find the rates you need

The standard VAT rate is 20%.

The reduced VAT rates are:

-

13% for: domestic flights, admission to sporting and cultural events, amusement parks, firewood, certain agricultural supplies, wine production (from farms), and cut flowers and plants for decorative use

-

10% for: foodstuffs, takeaway food, water supplies, pharmaceutical products, domestic passenger transport (excluding flights), international and intra-community road and rail transport, books (including e-books), newspapers and periodicals, pay and cable TV, TV licenses, social services, domestic refuse collection, treatment of waste and wastewater, restaurant services (excluding all beverages), cut flowers and plants for food production, certain agricultural supplies, and services by writers and composers

- 0% VAT rate applies to intra-community and international transport (excluding road and rail), and hotel accommodation

Note: VAT rates may vary in specific regions such as Jungholz and Mittelberg, where a 19% standard rate applies.

Belgium

The standard VAT rate is 21%.

The reduced VAT rates are:

-

12% for: restaurant and catering services (excluding beverages), certain social housing, and specific construction work on new buildings

-

6% for: basic foodstuffs (including takeaway food), water supplies, certain pharmaceutical products, medical equipment for people with disabilities, domestic passenger transport, books (including e-books), newspapers and periodicals, admission to cultural events and amusement parks, writers and composers, certain renovation and repair of private dwellings, hotel accommodation, admission to sports events, use of sports facilities, minor repairs of bicycles, shoes and leather goods, clothing and household linen, and hairdressing.

- 0% VAT rate applies to: intra-community and international passenger transport by air and sea, certain daily and weekly newspapers, and specific recycled materials and by-products

Note: VAT rates may vary in specific regions or under certain conditions.

Bulgaria

The standard VAT rate is 20%.

The reduced VAT rate is 9% for: hotel accommodation services, books and periodicals, both physical and electronic (excluding publications primarily intended for advertising or consisting mainly of video or audio content), baby foodstuffs and hygiene products

Note: Temporary reduced VAT rates for restaurant and catering services, sports facilities, and tourist services were in effect until the end of 2024. From 1 January 2025, these services are subject to the standard 20% VAT rate

- 0% VAT rate applies to:

-

Intra-community and international passenger transport by air and sea

-

Exports of goods to non-EU countries

-

Supplies of goods and services related to international transport, such as fueling and provisioning of vessels and aircraft

Croatia

The standard VAT rate is 25%.

The reduced VAT rates are:

-

13% for foodstuffs, takeaway food, water supplies, certain pharmaceutical products, hotel accommodation, restaurant services (excluding beverages), newspapers and magazines, cultural and sports event tickets, and certain agricultural supplies

-

5% for bread, milk, books (including e-books), certain medical equipment for people with disabilities, certain food products, and certain daily and weekly newspapers

- 0% VAT rate applies to intra-community and international passenger transport by air and sea

Cyprus

Czech Republic

The standard VAT rate is 21%

The reduced VAT rates are:

- 15% for foodstuffs, non-alcoholic beverages, take away food, medical equipment for people with disabilities, children’s car seats, some domestic passenger transport, some books (excluding e-books), admission to cultural events, shows and amusement parks, writers and composers, social housing, renovation and repair of private dwellings, cleaning of private households, some agricultural supplies, hotel accommodation, admission to sporting events, use of sporting facilities, social services, supplies to undertaker and cremation services, medical and dental care, domestic care services, firewood, some pharmaceuticals, some domestic waste collection and street cleaning, water supplies treatment of waste and waste water, food provided in restaurants and cafe cut flowers and plants for decorative use and food production

- 10% for newspapers and periodicals, some pharmaceutical products, some printed books

- 0% for intra-community and international transport

Denmark

The standard VAT rate is 25%

The reduced VAT rate is 0% for newspapers and journals, intra-community and international transport

Estonia

The standard VAT rate is 24% (effective from 1 July 2025).

The reduced VAT rates are:

-

13% for accommodation services (increased from 9% in January 2025)

-

9% for books (excluding e-books), newspapers and periodicals, certain pharmaceutical products, and medical equipment for people with disabilities

-

0% VAT rate applies to some passenger transport and intra-community and international transport

Note: Estonia raised its standard VAT rate from 22% to 24% mid-2025. Earlier in January 2025, press publications increased from 5% to 9%, and hotel VAT rose to 13%.

Finland

The standard VAT rate is 25.5% (increased from 24% on 1 September 2024).

The reduced VAT rates are:

14% for: foodstuffs, some agricultural supplies, restaurant services (excluding alcoholic beverages), some soft drinks, takeaway food, and plants for food production.

10% for: pharmaceutical products, domestic passenger transport, books (excluding e-books), newspapers and periodicals (sold by subscription), admission to cultural events and amusement parks, writers and composers, hotel accommodation, admission to sports events, use of sports facilities, and some domestic transport services.

0% VAT rate applies to: printing services for non-profit publications, intra-community and international transport, and certain gold ingots or coins.

Note: The standard VAT rate was increased from 24% to 25.5% on 1 September 2024. Many goods and services previously taxed at 10% were also reclassified to the 14% category.

France

The standard VAT rate is 20%.

The reduced VAT rates are:

-

10% for: certain foodstuffs, non-alcoholic beverages, domestic passenger transport, hotel accommodation, restaurants (excluding alcoholic beverages), takeaway food, bars, cafés, nightclubs, admission to amusement parks, pay/cable TV, some renovation and repair of private dwellings, certain cleaning of private households, some agricultural supplies, and firewood

-

5.5% for: most food products, water supplies, books (including e-books), newspapers and periodicals, admission to cultural events, writers and composers, certain pharmaceutical products, medical equipment for people with disabilities, and admission to sporting events

-

2.1% for: prescription drugs reimbursed by social security, certain press publications, and TV licenses

- 0% VAT rate applies to:

-

medical and dental care services

Note: VAT rates may vary in French overseas territories.

Germany

The standard VAT rate in Germany is 19% and applies to most goods and services.

- 7% is the reduced VAT rate and applies to essential goods like food, books, newspapers, and some cultural products. For takeaway and delivery food, the reduced rate of 7% also applies. However, food consumed on-site in restaurants is taxed at the standard 19% VAT rate since January 1, 2024, following the end of temporary COVID-19 measures. Most beverages are taxed at the standard rate of 19%, except for cow’s milk and dairy-based drinks like latte macchiato, which are taxed at 7%. Drinks made from plant-based milk, such as oat milk, are taxed at the standard 19% rate.

Greece

The standard VAT rate is 24%

The reduced VAT rates are:

- 13% for some foodstuffs, certain take away food, plants for food production, some non-alcoholic beverages, water supplies, some pharmaceutical products, some medical equipment for people with disabilities, some agricultural supplies, domestic care services, hotel accommodation, certain social services

- 6% for some pharmaceutical products, some books (no e-books), some newspapers and periodicals

- 0% for intra-community and international air and sea transport

Hungary

The standard VAT rate is 27%

The reduced VAT rates are:

- 18% for certain foods, some take away food, hotel accommodation

- 5% for certain foodstuffs, pharmaceutical products (for humans), some medical equipment for people with disabilities, books (excluding e-books), newspapers and periodicals, some social housing, district heating, some supplies of new building, restaurant and catering services internet access services, certain writers and composers services

- 0% for intra-community and international transport

Ireland

The standard VAT rate is 23%

The reduced VAT rates are:

- 13.5% for certain foodstuffs, some pharmaceutical products, children’s car seats, social housing, renovation and repair of private dwellings, cleaning in private households, some agricultural supplies, medical and dental care, collection of domestic waste, treatment of waste and waste water, minor repairs of bicycles, shoes and leather goods and household linen, construction work on new buildings, supply of immovable property, some social housing, routine cleaning of immovable property health studio services, certain tourist services, services photography

- 9% for certain foodstuffs, take away food, some bars and cafes, newspapers and periodicals, admission to cultural events and amusement parks, hotel accommodation, restaurants (excluding all beverages), use of sports facilities, hairdressing

- 4.8% for livestock intended for use in the preparation of foodstuffs, some agricultural supplies

- 0% for some foodstuffs, certain pet food, some medicine, certain feminine hygiene products, some medical equipment, clothing and footwear for children, intra-community and international transport, plants for food production

Italy

The standard VAT rate is 22%

The reduced VAT rates are:

- 10% for some foodstuffs, water supplies, some pharmaceutical products, domestic passenger transport, admission to cultural events, some social housing, renovation and repair of private dwellings, some supplies and construction work for new buildings, some agricultural supplies, hotel accommodation, restaurants, admission to certain sports events, energy products (excluding district heating), firewood, collection of domestic waste, some waste water treatment, alcoholic beverages in bars and cafés, take-away food, cut flowers and plants for decorative use and food production

- 5% for some foodstuffs, some social services

- 4% for some food products, certain medical equipment for people with disabilities, books, newspapers and some periodicals, e-books with an ISBN, online journals, some social housing, some agricultural supplies, certain social services, some supplies for new buildings

- 0% for intra-community and international transport

Latvia

The standard VAT rate is 21%

The reduced VAT rates are:

- 12% for food products for infants, pharmaceutical products, medical products for people with disabilities, domestic passenger transport, books (no e-books), newspaper and periodicals, hotel accommodation

- 5% for a range of locally produced vegetables and fruit

- 0% for intra-community and international transport

Lithuania

The standard VAT rate is 21%

The reduced VAT rates are:

- 9% for some domestic passenger transport, books (no e-books), newspapers and periodicals, hotel accommodation, district heating

- 5% for pharmaceutical products, medical equipment for people with disabilities

- 0% for intra-community and international transport

Luxembourg

The standard VAT rate is 17%

The reduced VAT rates are:

- 14% for certain wines, solid mineral fuels, mineral oils and wood intended for use as fuel with the exception of wood for heating, washing and cleaning products, administration of credit and credit guarantees by a person or organization other than that granting the credit

- 8% for cleaning in private households, minor repairs of bicycles, shoes and leather goods, clothing and household linen, hairdressing, district heating, natural gas, electricity, firewood

- 3% for foodstuffs, soft drinks, children’s clothing and footwear, water supplies, certain pharmaceutical products, certain medical equipment for people with disabilities, domestic passenger transport, certain books (no e-books), certain newspapers and periodicals, admission to cultural events and amusement parks, some pay TV/cable TV, agricultural supplies (no pesticides), hotel accommodation, restaurants (no alcoholic beverages), take away food, bars, cafes and nightclubs, cut flowers and plants for food production, supplies for of new buildings, some construction work on new buildings, admission to sports events, use of sports facilities, undertaker and cremation services, collection of domestic waste, treatment of waste and waste water

- 0% for intra-community and international transport

Malta

The standard VAT rate is 18%

The reduced VAT rates are:

- 7% for hotel accommodation, use of sporting facilities

- 5% for medical equipment for people with disabilities, books (except for e-books), newspapers and periodicals, admission to some cultural events, minor repairs of shoes and leather goods, bicycles, clothing, and household linens, domestic care services, supply of electricity

- 0% for some supplies of food for human consumption (no some processed and pre-cooked foods), prescribed medicines, gold ingots/bars, seeds for food production, live animals for human consumption, intra-community and international transport

Netherlands

The standard VAT rate is 21%.

From 1 January 2026, the reduced VAT rate for hotel accommodation (including holiday homes, B&Bs, and guesthouses) will increase to 21%.

- The reduced VAT rate is 9% for:

foodstuffs (not for animal consumption), some soft drinks, water supplies, certain pharmaceutical products, certain medical equipment for people with disabilities, domestic passenger transport (no air travel), intra-community and international transport, books (including e-books), newspapers and periodicals, admission to cultural events and amusement parks, writers and composers, certain renovation and repair of private dwellings, certain cleaning of private households, hotel accommodation, restaurants (no alcoholic beverages), takeaway food, bars, cafes and nightclubs, admission to sports events, use of sports facilities, minor repairs of bicycles, shoes and leather goods, clothing and household linen, hairdressing. - 0% VAT rate applies to:

taxation of gold coins, intra-community and international passenger transport by air and sea.

Poland

The standard VAT rate is 23%.

The reduced VAT rates are:

8% for: certain foodstuffs, passenger transport services, hotel accommodation, restaurant and catering services (excluding alcoholic beverages), newspapers, some pharmaceutical products, and certain medical devices.

5% for: basic food items (e.g. meat, dairy products), books (including e-books), children’s picture, drawing, and colouring books, maps and similar publications, and certain hygiene products including menstrual products.

0% VAT rate applies to: exports of goods to non-EU countries, intra-community and international passenger transport by air and sea, and the supply of rescue vessels and lifeboats used at sea.

Note: As of 1 January 2025, the standard VAT rate of 23% applies to live equines and smokable or inhalable hemp products (excluding those used solely for medical purposes). The VAT rate for menstrual cups was reduced from 23% to 5%.

Portugal

The standard VAT rate is 23%

The reduced VAT rates are:

- 13% for some foodstuffs, admission to certain cultural events, restaurant & cafe food, some agricultural supplies, wine, mineral water, diesel for agriculture

- 6% for some foodstuffs, water supplies, certain pharmaceutical products, medical equipment for people with disabilities, children’s car seats, children’s diapers, domestic passenger transport, some books (no e-books), certain newspapers and periodicals, TV license, social housing, renovation and repair of private dwellings, certain agricultural supplies, hotel accommodation, some social services, some medical and dental care, collection of domestic waste, minor repairs of bicycles, domestic care services, firewood, cut flowers and plants for decorative use and food production, construction work on new buildings, some legal services

- 0% for intra-community and international passenger transport

Romania

The standard VAT rate is 19% (with changes proposed for August 2025).

The reduced VAT rates are:

- 9% for foodstuffs, pharmaceutical products, medical equipment for people with disabilities, hotel accommodation, water supplies, restaurants and catering services (including supply of food in bars, cafes and nightclubs), some beer, soft drinks, cut flowers and plants for food production, some agricultural supplies

- 5% for social housing, books (no e-books), newspapers and periodicals, admission to cultural events, admission to sporting events

- 0% for intra-community and international passenger transport

Note: A VAT reform proposed for August 2025 would raise the standard rate from 19% to 21% and merge the 9% and 5% reduced rates into a single 11% rate.

Slovakia

The standard VAT rate is 23%.

The reduced VAT rates are:

-

19% for some foodstuffs, pharmaceutical products, medical equipment, books (excluding e-books)

-

5% for basic necessities, including selected baby products and newspapers

-

0% VAT rate applies to intra-community and international passenger transport

Note: As of 1 January 2025, the standard VAT rate increased from 20% to 23%, and the reduced rate from 10% to 19%. The super-reduced 5% rate remains in place.

Slovenia

The standard VAT rate is 22%

The reduced VAT rates are:

- 9.5% for some foodstuffs, pharmaceutical products, medical equipment for people with disabilities, domestic passenger transport, books (no e-books), newspapers and periodicals, cultural event, writers and composers, social housing, treatment of waste and waste water, use of sports facilities, undertaker and cremation services, agricultural supplies, hotel accommodation, admission to sports events, minor repairs of bicycles, clothes and household linen, certain supplies of new buildings, certain construction work for new buildings, shoes and leather goods, hairdressing, soft drinks, take away food, cut flowers and plants (decoration)

- 0% for intra-community and international passenger transport

Spain

The standard VAT rate is 21%.

The reduced VAT rates are:

10% for: pasta, seed oils, certain foodstuffs (excluding those taxed at 4%), pharmaceutical products, intra-community and international transport, some social housing, renovation and repair of private dwellings, agricultural supplies, some social services, domestic passenger transport, takeaway food, wastewater treatment, admission to sporting events, bars, cafés, nightclubs and alcoholic beverages sold therein, medical equipment for people with disabilities, and cinema tickets.

4% for: essential foodstuffs such as bread, milk, eggs, fruits, vegetables, flour, and olive oil; some pharmaceutical products; certain newspapers and periodicals; some medical equipment for people with disabilities; social housing; and some social services.

0% VAT rate applies to: intra-community and international passenger transport by air and sea, and the taxation of certain gold coins.

Note: Temporary VAT cuts on essential foods ended on 31 December 2024. From 1 January 2025, the reduced rates were reinstated: 4% for most essentials and 10% for seed oils and pasta.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

Sweden

The standard VAT rate is 25%

The reduced VAT rates are:

- 12% for some foodstuffs, non-alcoholic beverages, take-away food, clothing and household linen, hotel accommodation, restaurants, shoes and leather

- 6% for domestic passenger transport, books and newspapers, writers and composers, use of sport facilities

- 0% for medicines, printing and other services related to the production of magazines for non-profit organizations, intra-community and international passenger transport

Need help navigating changing VAT rates across Europe?

At hellotax, we help online sellers stay compliant with local VAT rules—no matter how often they change. Whether you’re selling on Amazon, your own webshop, or other marketplaces, our tools and expert support make VAT registration, filing, and reporting easy.

💡 Want to stay ahead of the next update?

Check out our latest guide on Common VAT Mistakes to Avoid in the EU—and learn how to keep your business compliant and stress-free across all your sales channels.

👉 Get in touch or book a free consultation to see how we can support your VAT strategy in 2025 and beyond.