Are you selling products to customers all across the EU via Shopify? Then this new hellotax feature is for you. We offer a new Shopify VAT Report integration feature that lets you easily connect your Shopify sales data to your hellotax Software Account – no matter which other bookkeeping or accounting software you might be using. Learn how it works in the article below.

Antonia Klatt

Last Updated on 20 May 2022

Why should you use the new Shopify Integration Feature

You know the problem. You connected your Shopify account to an accounting software to take care of bookkeeping but now it’s time to file VAT reports. Your standard accounting software is not equipped to handle VAT matters and neither are programs specialised on E-Commerce. Most likely the software is US-built and does not even correctly map out European VAT regulations, for example the One-Stop-Shop, the Reverse-Charge-Mechanism, and the EU-wide threshold.

You now have a choice: connect your Shopify account to a different software and get used to a different bookkeeping interface or use the Shopify plug-in feature by hellotax.

hellotax Shopify plug-in feature

Our new Shopify integration feature enables you to upload sales data from both Shopify or the accounting software of your choice – so that you can continue to monitor your bookkeeping the way you are used to while we take care of VAT across the EU. The Shopify plug-in feature is free to use with all our plans. Check out our pricing page to learn more about our service or book a call with out VAT specialists to find out how we can help automate and take care of your VAT duties!

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

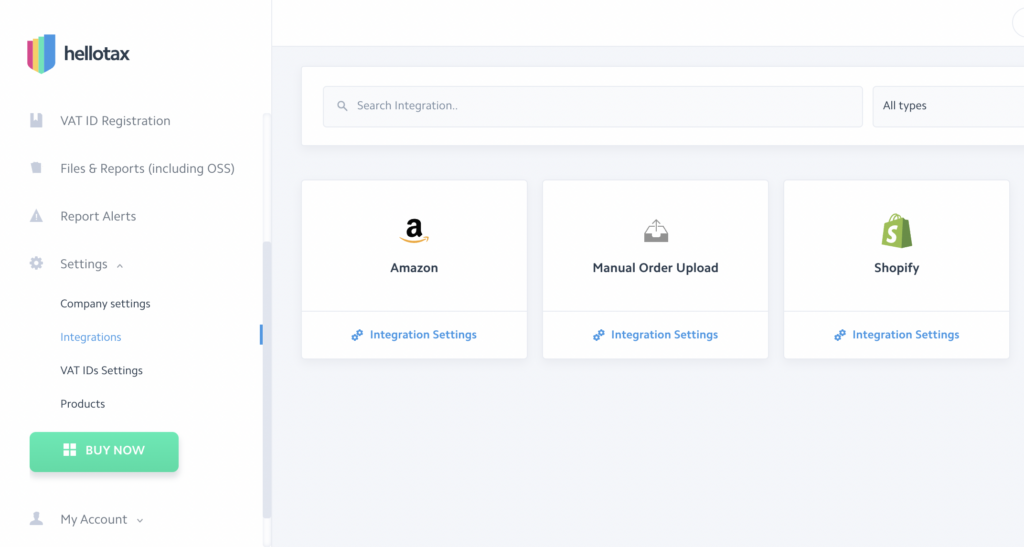

Taking advantage of several sales channels? Selling on Amazon but also building a reputation via your own label storefront with higher profit margins? Also not a problem for the hellotax software. Instead of purchasing a plug-in for each sales channel individually you can integrate transaction data form any and all sales channels into the hellotax software. We combine the data and you can concentrate on growing your brand.

How to use the new Shopify Plug-in Function

You can integrate your Shopify sales data into your hellotax Dashboard in just a few simple steps.

- Download Data from Shopify

- Upload Data

- Wait for your Upload

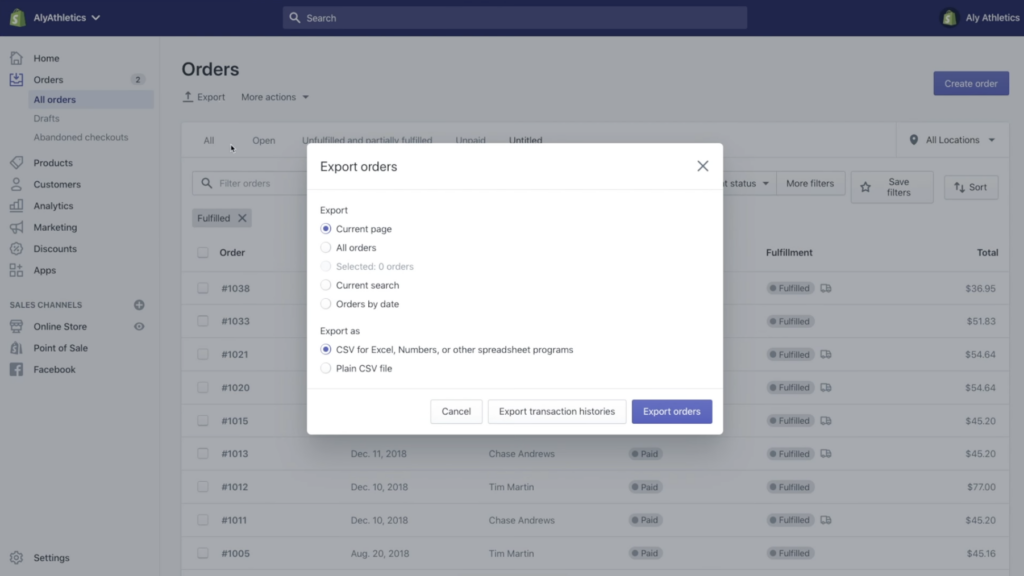

Once you completed some transactions or at the end of your VAT period, simply export the sales data in CSV or Excel format. You can export data not only directly from Shopify but also from a bookkeeping or accounting software of your choice.

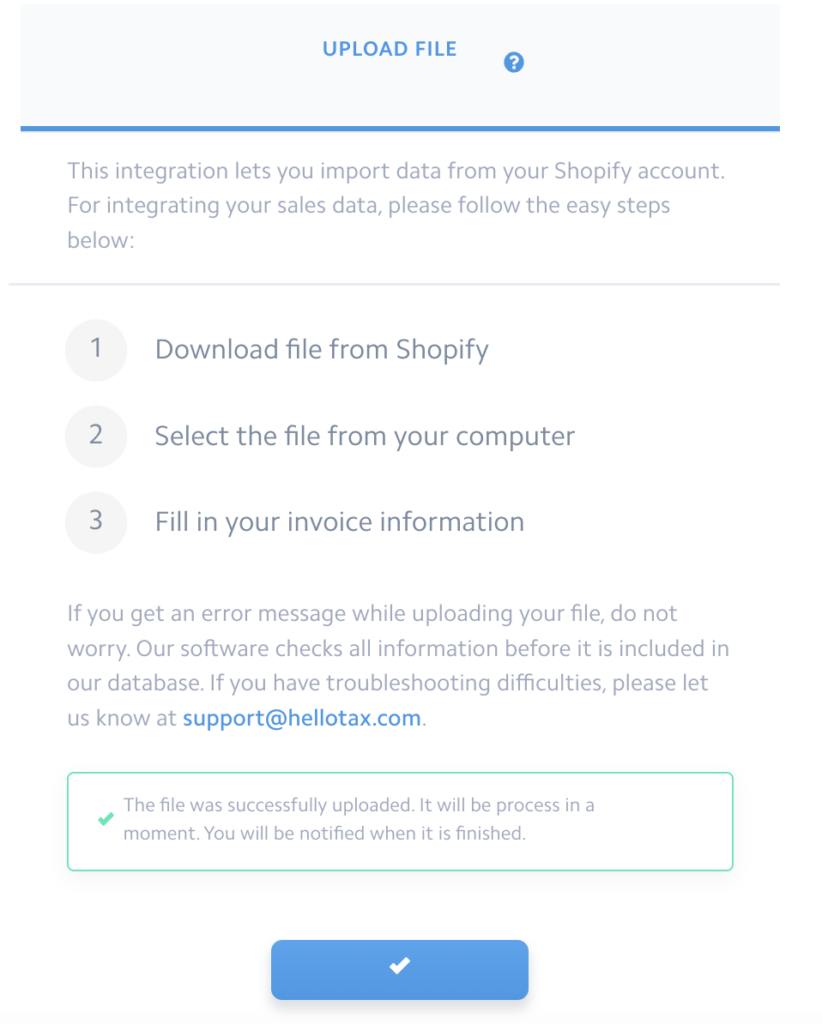

Got the data ready in Excel or CSV format? Then it’s time to upload. Visit the integration page in the hellotax software and simply upload the file. You can also upload files exported from other shop systems or even Amazon. The hellotax Shopify integration enables you to collect all relevant data from all your sales channels and take care of VAT of all kinds of transactions combined.

After just a few hours your transaction data appears in your hellotax dashboard. That is when we start sorting through and checking your sales and also begin compiling VAT or OSS reports. We will notify you when your report or VAT return is ready to be filed or once we received feedback from the tax authorities and you need to take care of a VAT payment.

Simple, convenient, safe!

Sounds interesting? Then contact us today, book a software demonstration with our VAT experts and learn more about how hellotax automates your VAT duties all across Europe.

Settings to change in Shopify before using the VAT Integration Function from hellotax

You will need to adjust some settings in your Shopify account for the hellotax software to correctly interpret your data. These changes are also necessary for Shopify to correctly display and charge VAT and you to trade and sell legally in the European Union.

Display net or gross prices on Shopify

First of all you need to choose between displaying prices with VAT included or with VAT excluded. This is more of a cultural than a legal choice. In most countries in the European Union customers are used to seeing, considering and comparing prices with VAT included. In contrast, customers in the US always need to calculate and add VAT to prices whenever they are shopping.

However, the setting also has implications for online sellers selling to business consumers. Thanks to the European Reverse-Charge-Mechanism VAT is not added to prices when selling to business consumers in a foreign EU country. These kinds of customers will be used to dealing with net prices.

To make your choice

- go to “Settings”

- click on “Taxes and duties”

- find “Tax calculations” and

- check or un-check “All prices include tax”

If you chose to display gross prices you will also need to

- go to “Settings”

- click on “Markets”

- find “Other markets” and click on “Preferences”

- check the “Include or exclude tax based on your customer’s country” box.

Manage your VAT registrations

Next, you need to manage your VAT registrations and let Shopify know which regulations you are taking advantage of. Your settings here should match the hellotax services you booked.

To make your choice

- go to “Settings”

- click on “Taxes and duties”

- find “Countries/regions” and click “European Union”

- find “Shipping within the EU” and click “Collect VAT”

If you are taking advantage of the EU-wide delivery threshold you need to select “Micro-business exceptions”. In this case all customers, no matter which EU country they are located in, will pay the VAT rate of your home country. Please note that while hellotax monitors the threshold, Shopify does not. Therefore you are liable for higher VAT even if you forget to switch your settings and don’t end up charging higher VAT rates once you cross the threshold.

If you are using the One-Stop-Shop procedure choose “One-Stop Shop registration”. In this case all customers will be charged the VAT rates applicable in their home country based on their location. In both cases you will need to select your “Registration country” and enter your “VAT number” once you made your choice.

If you are registered for VAT in several European countries, for example because you are storing products abroad” you need to choose “Country-specific registration”. You will then be asked to provide a VAT number for each country.

Conclusion

Looking for a Shopify VAT report integration? Then look no further! The hellotax VAT report integration for Shopify is not only convenient, it is also more flexible than regular VAT plugins for Shopify. It works with data exported from any software and any shop-system! Once you start using it, we can take care of all your VAT duties and you can continue to grow your Shopify business worry-free EU-wide.