- Are you storing goods and wares in Germany?

- Are you selling goods to German customers?

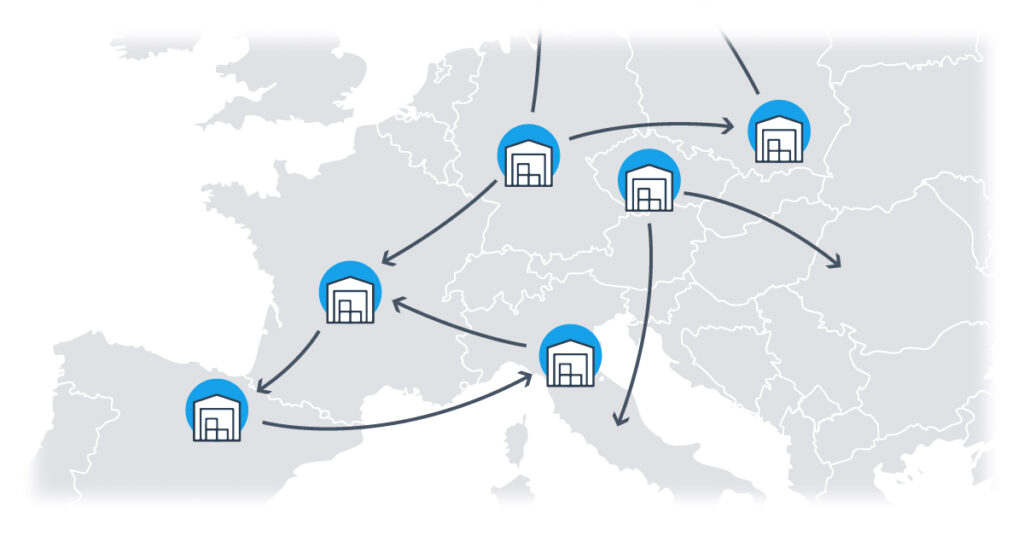

- Are you part of a FBA program, like the PAN-EU program?

If you answered “Yes!” to one or more of these questions, a VAT registration might be necessary. Our team at hellotax can help you with your VAT registration, Returns, or the communication with local authorities – we assist with all VAT duties that might arise.

Maria

Last Updated on 26 January 2024When do I need to register for VAT in Germany?

If you meet any of the following requirements, you must register for VAT in Germany:

You are storing goods in Germany

- As soon as you start storing goods in Germany or any other European country, you are subject to VAT.

- This includes both independent storage and storage as part of a fulfillment program or by a fulfillment provider with warehouses in Germany.

- In all of these cases, you need to register for VAT and also start filing VAT Returns.

You sell goods to Germany and cross the EU-wide delivery threshold

- If you sell goods and services in several European countries including Germany and exceed the EU-wide delivery threshold of € 10,000, you have to register for VAT.

- This is because crossing the threshold makes you subject to VAT in all European countries in which you are selling goods. VAT registration, the filing of VAT returns and regular payments of VAT are then mandatory.

- This does not apply if you participate in the OSS program and only sell goods in Germany, but do not store them (see below).

You are participating in an FBA (Fulfilled-by-Amazon) program

- When you participate in an FBA program, you authorize Amazon to store your goods in a variety of countries, depending on the program.

- For example, under the PAN-EU program, goods are stored in many Western European countries, including Spain, France and Germany.

- As Germany participates in a program, you have to register for VAT there, as the goods may be stored in Germany.

Are you distance selling more than € 10,000 EU-wide or storing goods in Germany? That means you have to firstly register for VAT in Germany and then start filing VAT Returns there. But no need to worry! If you contact us, we can support you in managing VAT duties, such as registration and filings. You can keep focusing on expanding your business in Germany. Check out all our services.

What information is required for the VAT registration in Germany?

By reaching or overstepping the VAT threshold or storing goods within the German borders, a German VAT ID becomes mandatory. To avoid trouble with the German tax system, you should take care of this matter as early as possible and register for VAT in Germany.

For the application of a VAT ID in Germany, you have to contact your local office of the “Finanzamt”, that’s what the German tax office is called. Simply find your local Finanzamt online and apply either online or by mail or simply in the hellotax VAT software.

Additionally the following documents need to be submitted:

- Home VAT certificate of the sole trader (dated not more than 6 months)

- Official Company registration certificate (must be issued within the last 6 months)

- Official Company certificate confirming the current company directors (must be issued within the last 6 months)

- An extract from the company’s national trade register

- Proof of the planned business (e.g., contracts or bills)

Please note: Some of the documents must be translated into German language by a sworn translator and certified by a sworn notary! Once you have completed your registration, you will receive a German VAT number.

What is the format of the VAT registration number in Germany?

| Name | Umsatzsteuer-Identifikationsnummer (USt.-IdNr.) / Umsatzsteuernummer |

| Country Code | DE |

| Format | DE + 9 digits |

| Example | DE123456789 |

Register in time to avoid problems with the German tax authorities or fines. You can make your VAT registration in Germany easier by using our hellotax VAT automation tool. Further, you can automate VAT payments, VAT returns and correspondence with the authorities. Check it out now!

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

Distance Selling to Germany and the EU-wide threshold

In July 2021, the regulations for the delivery thresholds were changed. Previously, country-specific delivery thresholds, such as the German one of € 100,000, were used to determine VAT subjectivity in each country. Since then, an EU-wide threshold value for distance selling of € 10,000 has been the decisive factor. If the net value of distance sales exceeds this number, a seller is subject to VAT in all European countries in which he sells. Each additional euro is then taxed at the corresponding VAT rates, VAT registrations are due and the submission of VAT returns in each country are mandatory. If the net turnover remains below the threshold, B2C deliveries and services are taxed at the rate of the company’s home country and VAT is paid there.

Attention: Reaching individual country-specific thresholds is no longer the decisive factor for VAT liability. The new VAT threshold of € 10,000 also applies across the EU. As soon as this threshold is reached across the board, for example through sales to France, Spain, and Germany combined, VAT registration is due in all of these countries at the same time.

Example: You are an Italian distance seller with an annual net turnover of € 11,000. € 6,000 of those net sales are made in France, € 3,000 in Spain, and € 2,000 in Germany.Since the net turnover exceeds the EU-wide threshold of € 10,000, you are subject to VAT and need to register for VAT in all three countries. While the first € 10,000 are taxed with the Italian VAT rate, the additional € 1,000 need to be taxed with country-specific VAT rates. If all sales in France and Spain were made first and the sales to Germany tipped the scale, then € 1,000 of those sales need to be taxed with the German VAT rate.

What happens if I participate in the OSS-Program?

The EU-wide delivery threshold of € 10,000 does not apply if you register for the One-Stop Shop. On the one hand, individual VAT registrations are no longer required in all the countries you sell to. Instead, the VAT is declared and paid to the tax office in your home country. From there, the money is distributed to the countries that the VAT is owed to. However, all distance sales from the first euro onwards must be taxed at the corresponding country-specific VAT rates, in Germany regularly 19%.

Attention: While pure distance sellers don’t need to register for VAT if they use OSS, the situation changes once products are stored. Then, a VAT registration is necessary again. If goods stored are then sold to customers in the country of storage, e.g. Germany, the sales need to be declared in an additional VAT declaration in Germany and VAT needs to be paid directly to the German authorities.

Example: If the Italian distance seller active in France, Spain and Germany uses OSS, each sale starting from the first needs to be taxed with the French, spanish, and German VAT rate respectively. However, VAT registrations in those three countries are not obligatory. The VAT debt is paid to the italian tax authorities and those distribute the correct amounts to the French, spanish, and German authorities.

Want to stay VAT compliant? hellotax can help you with all kinds of VAT questions. We can take care of your registration for VAT in Germany or OSS, with regular VAT returns, and more. Contact us today, choose the best option for your business, and avoid fines.

Hellotax One-Stop-Shop Solution

- Automated identification of B2C sales

- Automated determination of your tax rates

- Handling of OSS registrations and reports

- Quality control for your transactions

FAQ

Which VAT rates are there in Germany?

In Germany, the standard VAT rate is 19% and it applies for most goods and services sold in Germany. There is also a reduced rate of 7% which applies for example for books or water supplies. Under certain conditions, a zero VAT rate can also apply (0%).

When and how often do I need to file VAT returns in Germany?

When and how often you need to file VAT returns in Germany depends on your annual turnover. The filing periods can be monthly, quarterly or annually. Clarify with your tax advisor which filing scheme applies to you

How long does it take to get a German VAT number?

After all the documents are submitted to the authorities and the registration process is completed, it takes about 11 weeks until you receive your German VAT number.