- Are you storing goods in the Czech Republic?

- Are you selling goods to customers in the Czech Republic?

- Are you part of an FBA program that includes the Czech Republic?

If one or more applies, a VAT Registration in the Czech Republic is required. You might also need to start filing VAT Returns and frequently communicate with the local authorities. Need help? The hellotax team can take care of all VAT related duties for you. Book a consultation today!

Dominik Larcher

Last Updated on 2 May 2022When do I need

to submit a VAT registration in the Czech Republic?

Reason 1: You are storing goods in the Czech Republic

- Storing goods in a EU-country requires you to register for VAT in that country.

- No matter if the storage happens independently or via a fulfillment provider which stores products in warehouses in Austria, the seller himself is responsible for the VAT registration.

- In some cases the subsequent filing of VAT returns and tax declarations are also necessary.

Reason 2: You selling goods to Czech end-consumers crossing the EU-wide distance selling threshold

- Since July 2021, a VAT registration in EU-Countries to which you are selling is mandatory if distance sales across the EU cross the new € 10,000 threshold.

- Distance sales below that threshold don’t require an additional VAT registration.

- The same applies to business registered for OSS, through goods need to be taxed with country-specific VAT rates in that case.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

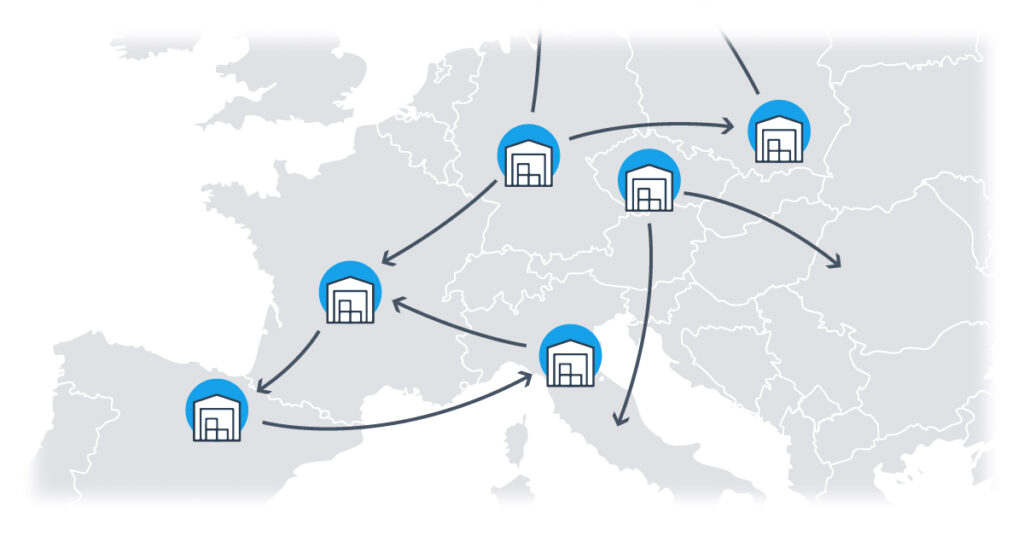

Reason 3: You are participating in the CEE or Pan-EU Fulfillment programs by Amazon

- If you are participating in a Fulfilled-by-Amazon program you are authorizing Amazon to store your goods and wares in warehouses in several countries, depending on the program.

- For example, the Central European Program includes warehouse in Poland, the Czech Republic, and Germany, while the Pan-EU program includes a multitude of European countries including the Czech Republic.

- In both cases you need to register for VAT in the Czech Republic, as your wares might be stored there.

Are you storing your goods in Czech warehouses or distance selling to the Czech Republic and crossing the threshold?

Then you need to register for VAT with the Czech tax authorities and maybe also need to start filing VAT returns. If you want to make sure you are staying VAT compliant, book a consultation with us. hellotax can help you with all filings and the communication with the Czech authorities while you keep focusing on your business in the Czech Republic.

How do I submit

a VAT registration in the Czech Republic

To register for VAT in the Czech Republic you need to fill in the online application form. Note that the website and the form are only available in Czech language.

A VAT registration in the Czech Republic can only be submitted electronically. It is not possible to send it via post. Only the original Letter of Authority, stating who is authorized to communicate on your behalf with the tax authorities, must be sent by post to the following address:

Finanční úřad pro Moravskoslezský kraj

Územní pracoviště Ostrava I

Jurečkova 940/2

700 39 OSTRAVA

Additionally, during the application the following documents need to be submitted

- An extract from the company’s national trade register

- VAT certificate to prove the business is registered for VAT elsewhere in the European Union

- Licence to execute economic activities

Some of the documents must be translated into Czech by a sworn translator and certified by a sworn notary! Once you have completed your registration, you will receive a Czech VAT number.

How does the format of a Czech VAT registration number look like?

| Name | Daňové identifikační číslo (DIČ) |

| Country Code | CZ |

| Format | CZ + 8, 9, or 10 digits |

| Example | CZ12345678, CZ123456789, or CZ1234567890 |

If you want to make sure that you are registered for VAT in time and file Czech VAT returns properly, you can check out hellotax’s services and automation tools. We can make all VAT related duties easier by automating VAT payments and take over the correspondence with the Czech authorities for you.

Check it out now!

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

The EU-wide threshold

Tand Distance Selling to Poland

Regulations concerning the threshold as the decisive factor for VAT subjectivity were changed in July 2021. While country-specific VAT thresholds, such as the Czech one of CZK 1,140,000, were used before, an EU-wide threshold for distance sales of € 10,000 replaced those in July. Sales whose combined net worth does not cross this line are taxed in the home country of the business and the VAT is paid to those authorities. However, each additional Euro after the threshold is crossed has to be taxed with the VAT rates of the countries to which goods are sold. VAT registrations there are then necessary in order to declare the VAT, file VAT returns, and pay VAT to the local authorities.

Attention: The new threshold applies across the EU, meaning that all sales to European countries are added up. Once the threshold is crossed, VAT registrations become due in all countries at the same time.

Example: You are a French distance seller selling goods to Germany, Poland, and the Czech Republic. Your turnover in Germany is € 6,000, your turnover in Poland is € 3,000 and your turnover in the Czech Republic is € 2,000. Combined, all those sales exceed the threshold of € 10,000. Which sales need to be taxed with the German, Polish and Czech VAT rates depends on which sales were made after the crossing of the threshold. If all sales to Germany and Poland were made before the sales to the Czech Republic, the half of the ladder – or € 1,000 – are subject to the Czech VAT rate. All previous sales to Germany and Poland and the first € 1,000 made in the Czech Republic are taxed with the French VAT rate as those sales took place before the € 10,000 mark was hit.

How does participation

in the OSS-Program change the rules?

Participation in the European One-Stop-Shop changes the obligations to register for VAT in the Czech Republic in so far, that it is no longer necessary to submit multiple registrations if a participant only distance sells to but not stores in other countries. While each and every sale is taxed with country-specific VAT rates, in the case of the Czech Republic regularly 21%, all VAT debt is paid to the businesses home country. The tax authorities there then redistribute the VAT to the countries to which goods were sold. Therefore additional registrations for VAT are no longer necessary.

Attention: The rules only apply if the seller is only distance selling but not storing in the Czech Republic. As soon as he or she stores, the rules for VAT registrations change and an individual Czech registration for VAT is again obligatory. For products delivered to Czech customers from warehouses in the Czech Republic the seller also needs to fill out an individual Czech VAT declaration and pay the amounts directly to the tax authorities in the Czech Republic.

Example: The French distance seller in the example above is now using OSS instead of the EU-wide threshold for distance sellers. In this case each sale needs to be taxed with the German, Polish, and Czech VAT rates respectively. However, he now pays all of the VAT to the French authorities and therefore doesn’t need to register for VAT in the Czech Republic, Poland, or Germany.

If you’re confused about which option is best for your business, don’t hesitate to contact us. The hellotax team can help you with both registration for OSS or VAT in the Czech Republic. We can also help navigate VAT responsibilities in several countries and make sure you stay VAT compliant!

Hellotax One-Stop-Shop Solution

- Automated identification of B2C sales

- Automated determination of your tax rates

- Handling of OSS registrations and reports

- Quality control for your transactions

FAQ

What are the different VAT rates in the Czech Republic?

The standard VAT rate in the Czech Republic is 21%. It applies for taxable goods and services. The reduced rate of 15% taxes for example non-alcoholic beverages or take away food. 10% are taxed on some newspapers and periodicals or some pharmaceutical products. The tax rate of 0% applies for intra-community transport.

What are the tax periods for my VAT returns in the Czech Republic?

You normally file your VAT returns in the Czech Republic monthly. If you company has been registered for at least three years and has an annual turnover of less than CZK10,000,000 (ca. €388,000) you can file your VAT return quarterly.

When are the deadlines for my VAT returns in the Czech Republic?

The deadline for any Czech VAT filing is always the 25th of the months following the tax period. The monthly filing for January is due until February 25, the quarterly filing of the first quarter is due until April 25.

How long do I have to wait for my Czech VAT registration number?

After all the documents are submitted to the authorities and the registration process is completed, it takes about 2 weeks until you receive your Czech VAT number.