For the most updated information please check our newest article.

Dominik Larcher

Last Updated on 25 June 2025- Are you storing your goods in Italy?

- Are you selling goods to private customers in Italy?

- Are you part of a fulfillment program?

You may need a VAT registration in Italy.

If any of those points apply to you, then you certainly need a VAT registration in Italy and may have to file VAT returns regularly. The hellotax can help you with both of those and many other Italian VAT duties. We can also take over the communication with the Italian authorities. Interested? Contact us today!

When do I need to

register for VAT and

obtain a VAT ID in Italy?

Reason 1: You are storing your goods and wares in Italy

- If you are storing your goods and wares in Italy, be it in a warehouse or independently, you have to obtain an Italian VAT ID.

- In order to do so you have to register for VAT with the Italian tax authorities.

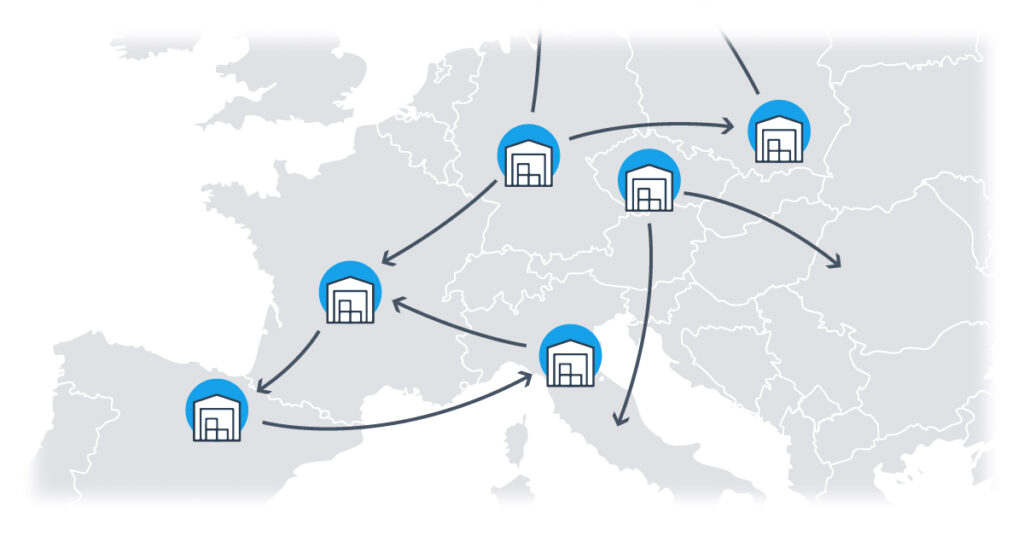

- You also have to register for VAT in any other European country you might be storing your goods in since you will need separate VAT IDs for each country.

Reason 2: You are participating in an FBA program (Fulfilled-by-Amazon)

- Italy is part of the Amazon PAN-EU program. That means that the goods of sellers who participate in this program might be stored there.

- Even if the seller doesn’t explicitly know about the storage in Italy, by participating in the program, Amazon is authorized to do so.

- Apart from Italy, you also have to register for VAT in all other countries that are part of the FBA program.

Reason 3: You’re crossing the delivery threshold while selling to Italian customers

- Apart from storage, crossing the EU-wide threshold for distance selling is another reason that requires you to submit a VAT registration in Italy and other European countries.

- Once the net worth of distance sales exceeds €10,000, individual VAT registration in all countries to which sales are made is mandatory, as long as the seller doesn’t participate in the OSS program (more information below).

- As long as sales stay below the threshold, additional registrations in Italy and elsewhere are not necessary, but may be advisable.

Are you confused about your VAT subjectivity? Do you need assistance with registrations or filings? hellotax can help! Contact us today and we can advise you about your options and take over your VAT responsibilities, including the communication with the Italian-speaking authorities.

How do I complete a

VAT registration in Italy?

You need to contact the Italian tax office to start your VAT application. The Italian authorities mainly communicate in Italian, which means you need a local representative for communication. When you fill in all the forms, you send a signed hard copy together with additional documents to the tax office.

Additionally, the following documents need to be submitted:

- Declaration for a non-permanent establishment of the company in Italy

- Industry classification form

- VAT certificate

- Articles of Association and Memorandum

- Registration for intra-community supplies and VIES registration

- Latest verified company accounts

- Power of attorney for the legal representative of the company, signed passport photo required

Some of the documents must be translated into the Italian language by a sworn translator and certified by a sworn notary! Once you have completed your registration, you will receive an Italian VAT number.

What does the format of an Italian VAT registration number look like?

| Name | Il numero di registrazione IVA (P. IVA) |

| Country Code | IT |

| Format | IT + 11 digits |

| Example | IT12345678901 |

Unsure about how to communicate with the Italian authorities? Want to prevent problems and fines due to late registrations? We can help. The hellotax automation tool can automate VAT payments and filings, while our team of experts can help you with registrations, correspondence, and more. Contact us today!

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

Crossing the EU-wide threshold

while distance selling to Italy

Crossing the EU-wide threshold for distance selling of €10,000 is the most common reason for sellers to register for VAT in Italy. Before July 2021, registration for VAT in Italy was only necessary if distance sales to Italy exceeded the Italian threshold of €35,000. Since then, the EU-wide threshold of €10,000 has been in place. If the net worth of your combined distance sales to European countries crosses this threshold, a VAT registration is required in each country where customers are located. The additional sales also need to be taxed with the corresponding country-specific VAT rates. B2C sales whose net worth stays below the threshold are taxed at the VAT rate of the home country. This VAT is paid directly to the tax authorities at home, and additional VAT registrations, such as those in Italy, are therefore not necessary.

Attention: The seller might be surprised by several mandatory VAT registrations arising at the same time. That is because the threshold applies EU-wide and can therefore be crossed by selling small amounts to several European countries. Individual country-specific thresholds no longer determine VAT subjectivity.

Example: A German distance seller who sells to French, Spanish, and Italian customers is taking advantage of the EU-wide delivery threshold. Since he records a turnover of € 6,000 in France, € 3,000 in Spain, and € 2,000 in Italy, he crosses the threshold by € 1,000. Therefore, he needs to register for VAT in Italy and the two other countries. Which sales need to be taxed with which VAT rates depends on when the sales were made. The first € 10,000 is subject to the German VAT rate, while the additional € 1,000 is subject to a foreign rate. If those goods were sold to Italian customers, then the Italian VAT rate needs to be applied.

What happens if I

participate in the OSS Program?

The foreign VAT rate always needs to be applied if a seller is participating in the OSS program, even for the first € 10,000 worth of distance sales. The advantage of the One-Stop-Shop is that there is no longer a need to individually register for VAT in the foreign European countries. Instead all VAT is paid to the local tax office. The home country then distributes the correct VAT amounts to all countries to which VAT is owed.

Attention: The OSS prerequisites for VAT registration apply as long as a distance seller doesn’t store in a foreign country. As soon as storage is involved, a VAT registration is due, whether or not the OSS program is used. In case of delivery from a foreign storage facility to a private customer in the same country an additional VAT return and direct payment to the local tax authorities are also needed.

Example: If the German distance seller were to use the OSS program instead of taking advantage of the delivery threshold, he would have to apply the French, Spanish, or Italian VAT rates to each and every transaction. He would pay all VAT to the German authorities since he has a German VAT ID and is registered there. A registration for VAT in Italy would no longer be necessary.

Need help with OSS registration? Confused about which route is the right one for your business? The hellotax team can advise you concerning all VAT-related issues and can take over some of your VAT responsibilities in Italy and beyond.

Book a free consultation

Our VAT experts are happy to help you. Book a free consultation today!

FAQ

What are the different VAT rates in Italy?

The standard VAT rate that applies for goods and services is 22% in Italy. The reduced type of 10% applies for example for certain foodstuffs or water supplies. The rate of 5% includes for example some social services. 4% VAT are taxed on e.g., certain books, newspapers and periodicals. The VAT rate of 0% applies for intra-community transport.

When are VAT returns to be filed in Italy?

In Italy, all taxpayers must file a quarterly VAT return. This is called “Comunicazione Liquidazioni Periodiche IVA”. Companies with an annual turnover of more than €700,000 must file monthly VAT returns. Businesses below this limit can pay quarterly but they pay a 1% non-refundable surcharge. An annual VAT return is required, too.

When are the deadlines for my VAT returns in Italy?

The VAT returns must be filed by the 30th day of the second month following the tax period. For the first quarter, the deadline would be 31 May. Annual returns must be filed by 30 April of the following year.

How long do I have to wait for my VAT number in Italy?

After all the documents are submitted to the authorities and the registration process is completed, it typically takes about 8 to 9 weeks to receive your Italian VAT number. This timeframe is mainly due to the processing workload of the Italian tax authorities.