Amazon VAT registration in Europe can be complex — especially when expanding across multiple countries.In this case, we show how hellotax …

Estonia VAT rate rises to 24%: what online sellers must know

For our last article on Estonian VAT compliance, please, check here. Starting 1 July 2025, the standard Estonia VAT rate will increase from …

Continue Reading about Estonia VAT rate rises to 24%: what online sellers must know →

France VAT rates in 2025: : Standard and Reduced Rates Explained

Discover France VAT rates in 2025. Learn about standard and reduced rates (20%, 10%, 5.5%, 2.1%) and key compliance updates for online …

Continue Reading about France VAT rates in 2025: : Standard and Reduced Rates Explained →

VAT rates in Italy: all the updated information 2025

As part of the European Union, Italy is naturally also using VAT to handle national and international sales. This article will briefly show …

Continue Reading about VAT rates in Italy: all the updated information 2025 →

How long does a VAT registration take?: VAT registration times

There are differing processing times for VAT registration, depending on the country. It can vary between 4 and 12 weeks, depending on the …

Continue Reading about How long does a VAT registration take?: VAT registration times →

EU VAT SME Scheme 2025: VAT Simplification for Small Sellers

The EU VAT SME scheme, coming into effect in January 2025, is part of the EU’s wider VAT reform aimed at supporting small enterprises and …

Continue Reading about EU VAT SME Scheme 2025: VAT Simplification for Small Sellers →

Step-by-Step: Registering for the IOSS for Non-EU Sellers

Navigating EU VAT regulations can feel overwhelming for non-EU online sellers. However, the Import One-Stop-Shop (IOSS) provides a …

Continue Reading about Step-by-Step: Registering for the IOSS for Non-EU Sellers →

VAT Registration in the Netherlands: A Complete Guide for Ecommerce Businesses

Why the Netherlands is a Prime Ecommerce Market The Netherlands offers a highly attractive environment for ecommerce businesses. With …

VAT Number in Spain: How to Get It, Format & Threshold Limit

Expanding abroad allows retailers to access new markets and significantly increase sales. With a population of nearly 50 million, Spain is a …

Continue Reading about VAT Number in Spain: How to Get It, Format & Threshold Limit →

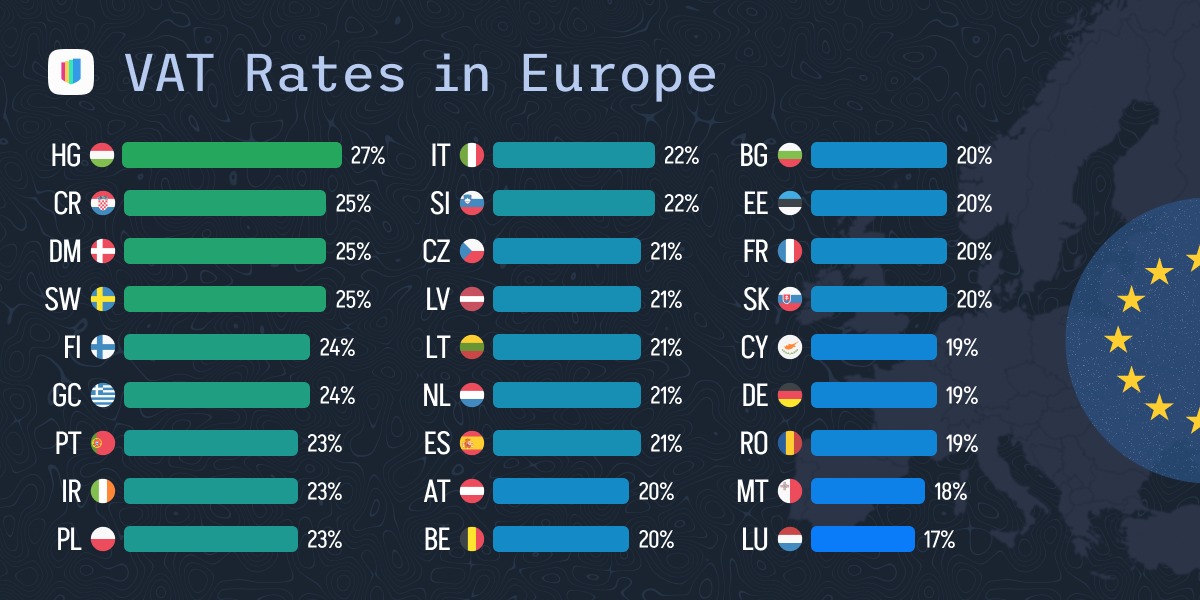

VAT rates in Europe 2025: Definition, Actual Value-Added-Tax Rates

VAT ensures the proper handling of taxes when selling in Europe. All goods and services sold in the EU are subject to this consumption tax. …

Continue Reading about VAT rates in Europe 2025: Definition, Actual Value-Added-Tax Rates →