Avalara stops VAT services for Amazon Sellers

E-commerce sellers across the EU are facing significant changes as Avalara, a leading VAT ...

Almanya’da KDV Kaydı

Almanya’da ürün veya eşya mı depoluyorsunuz? Alman müşterilere ürün mü satıyorsunuz? ...

Dropshipping & Mehrwertsteuer: Beispiele, Sonderregelungen und Ausnahmen

Dropshipping ist eine Liefer- oder Fulfillment-Methode, die es Einzelhändlern ermöglicht, ohne ...

VAT ID: VAT number format

The value-added identification number (VAT ID number) and the tasks associated with it can be ...

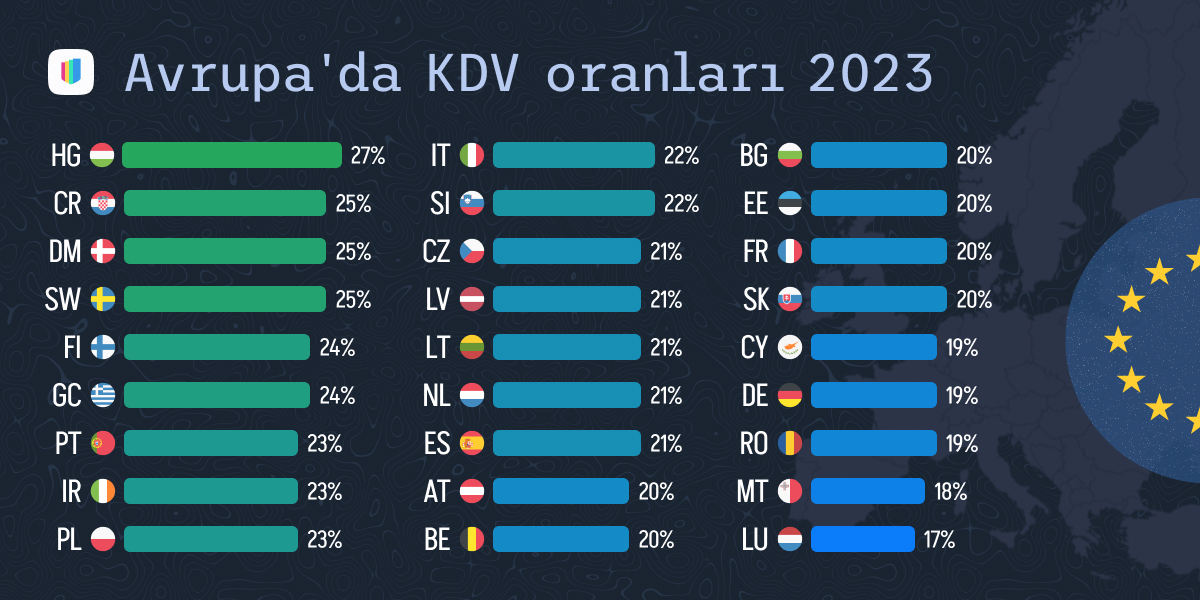

Avrupa’da KDV oranları: Tanım, Gerçek Katma Değer Vergisi Oranları

Avrupa’da satış yaparken vergilerin düzgün bir şekilde ele alınmasını sağlamak için KDV ...

A guide to VAT backdating registration and filings in Europe

The timing of VAT registration for your business is more than just a matter of convenience ...

How to Pay VAT Online in Germany: A Guide for Online Sellers

As a business engaged in transactions in Germany, understanding and managing your Value Added ...

Optimizing VAT in the EU: How Estonia Can Benefit Your Online Business

For our last article on Estonian VAT compliance, please, check here. Expanding a business ...

Understanding VAT Letters from the German Tax Office: A Seller’s Survival Guide for online sellers

As an online seller in Germany, do you have any trouble understanding VAT letters from the ...